MONEY SUPERMARKET

Trend forecasting and future proofing MSM’s mobile product roadmap

Project date: 2015 / 2016

IN A NUTSHELL

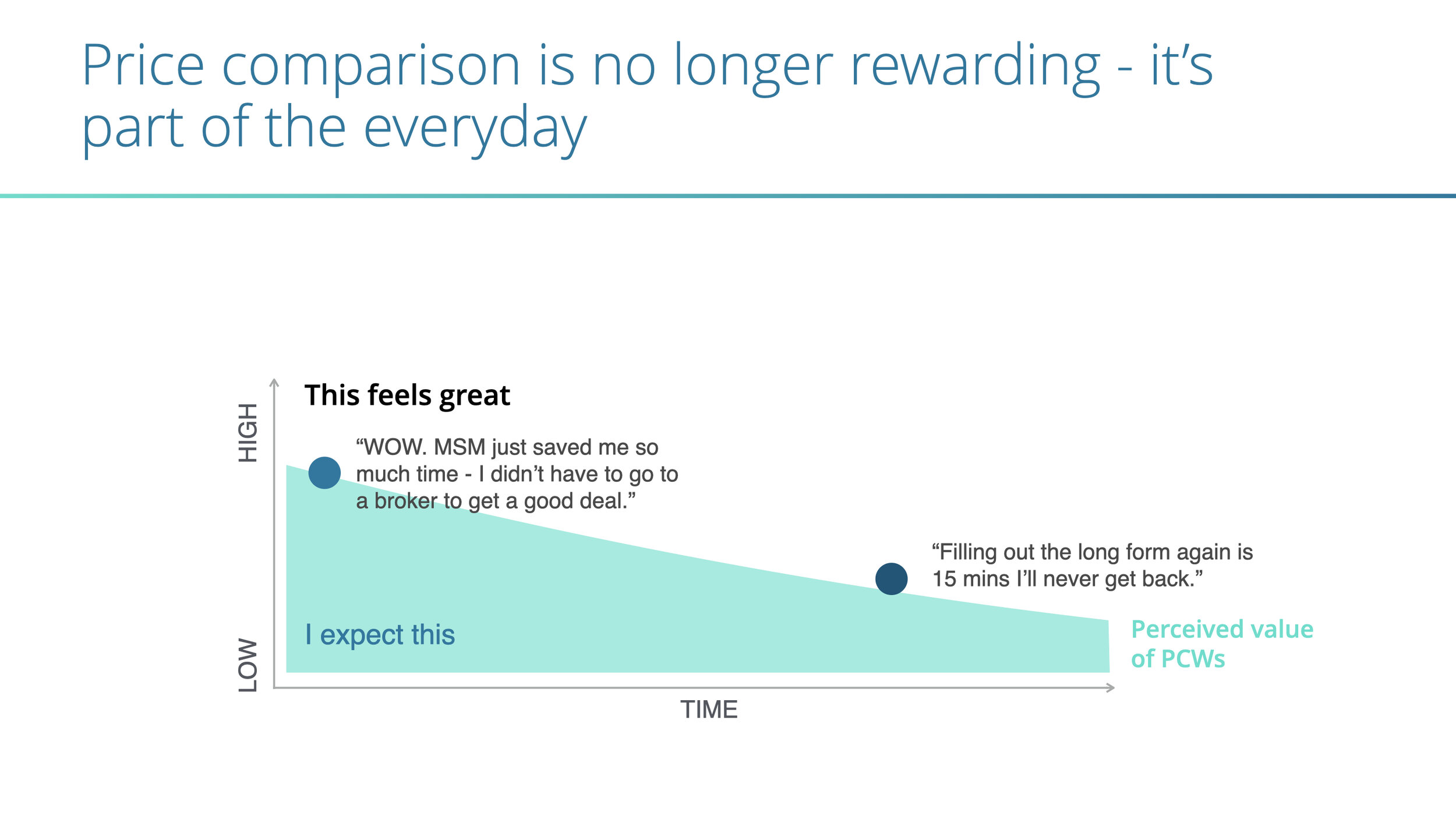

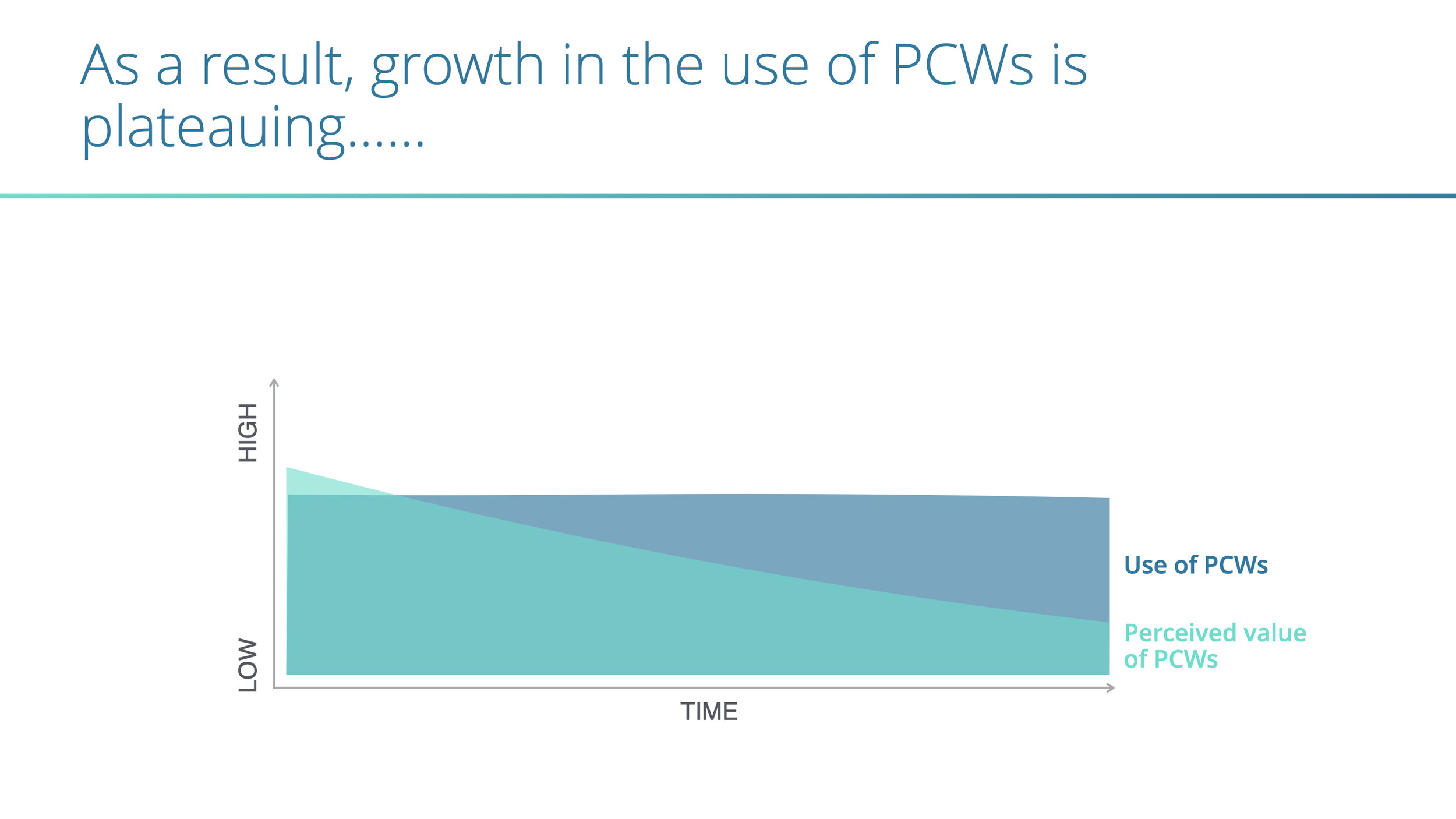

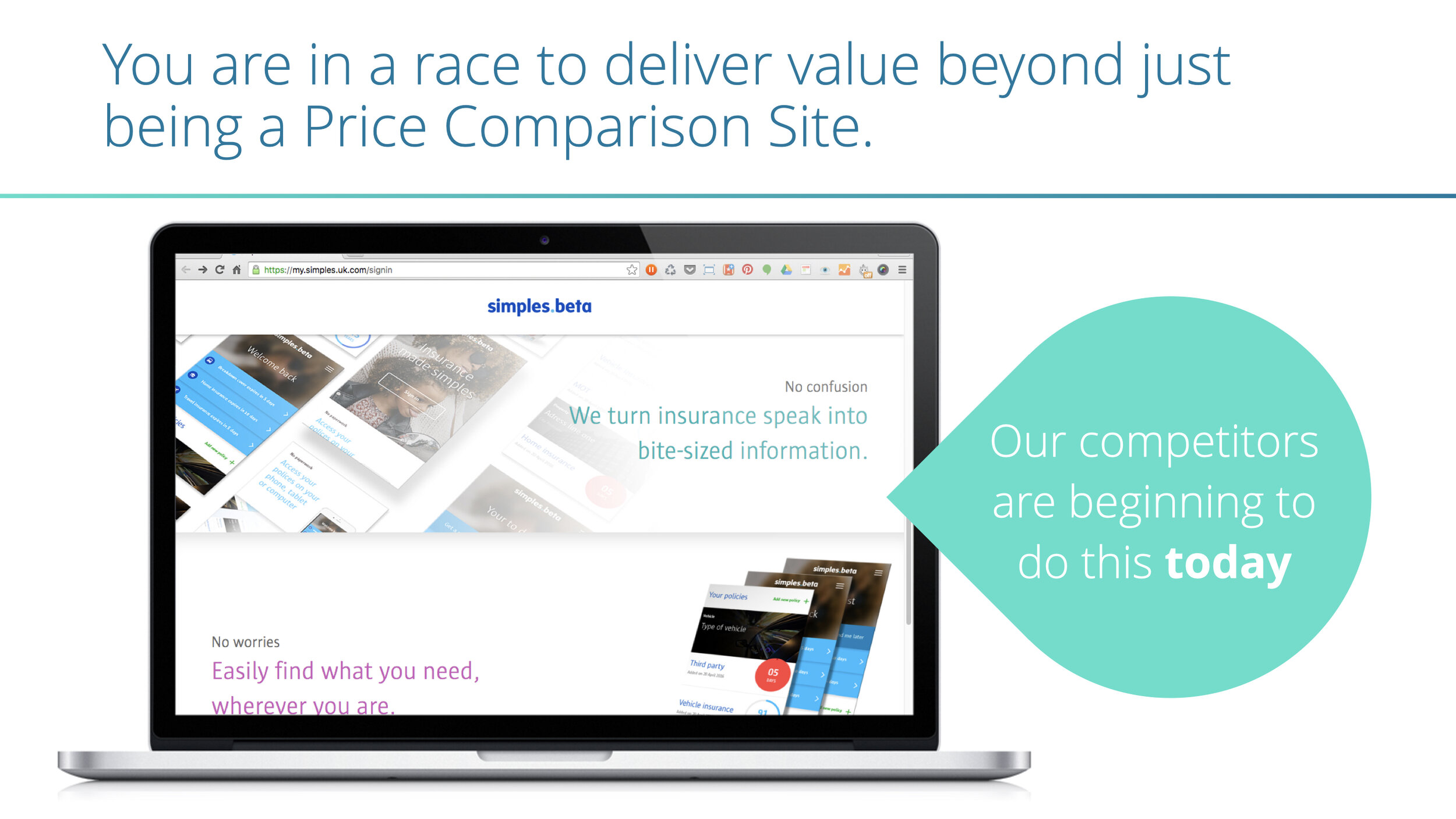

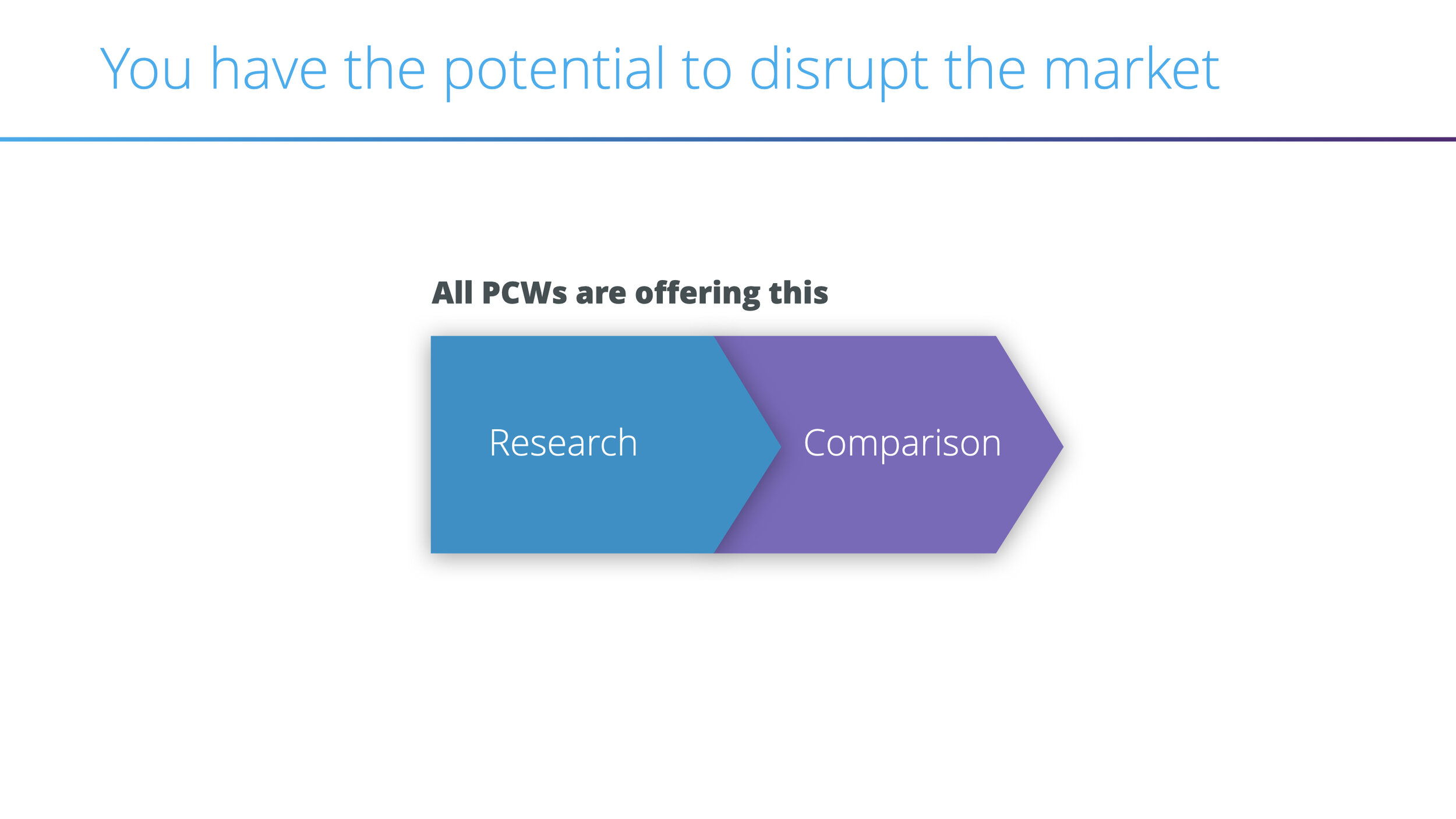

MoneySupermarket were losing market share in a saturated market where the best price comparison sites offered the same features and were only differentiating from each other through marketing campaigns and massive ad spend.

Internally senior stakeholders felt they needed a clear vision for where their product should be in 3 years-time to inform today’s investment decisions and their current product roadmap.

MSM asked Beyond to first paint a picture of what the personal finance world would look like in 3 years-time. What would customers expect? How might emerging technologies provide opportunities or a threat to MSM? Which digital personal finance brands were moving into MSM’s space?

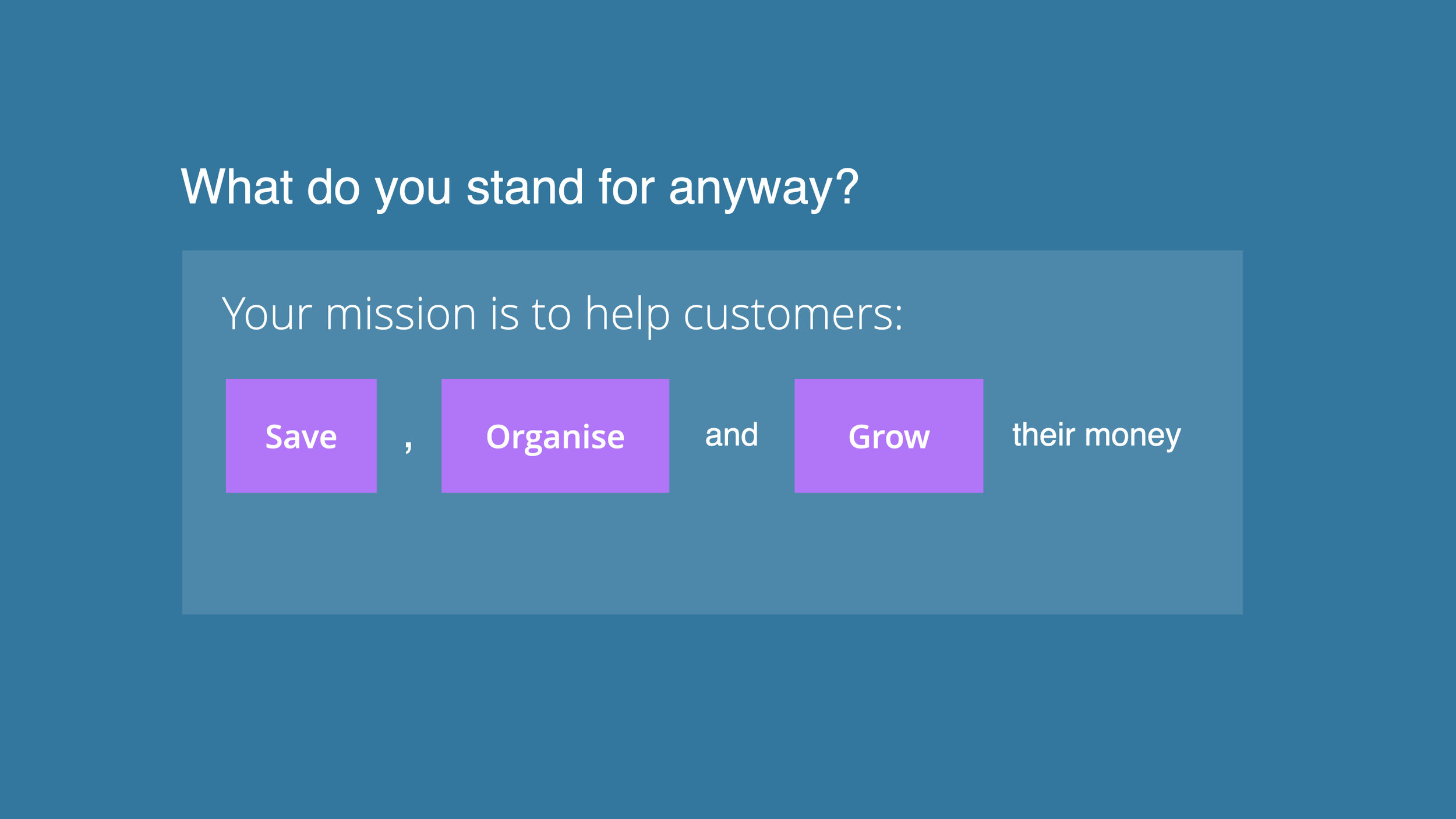

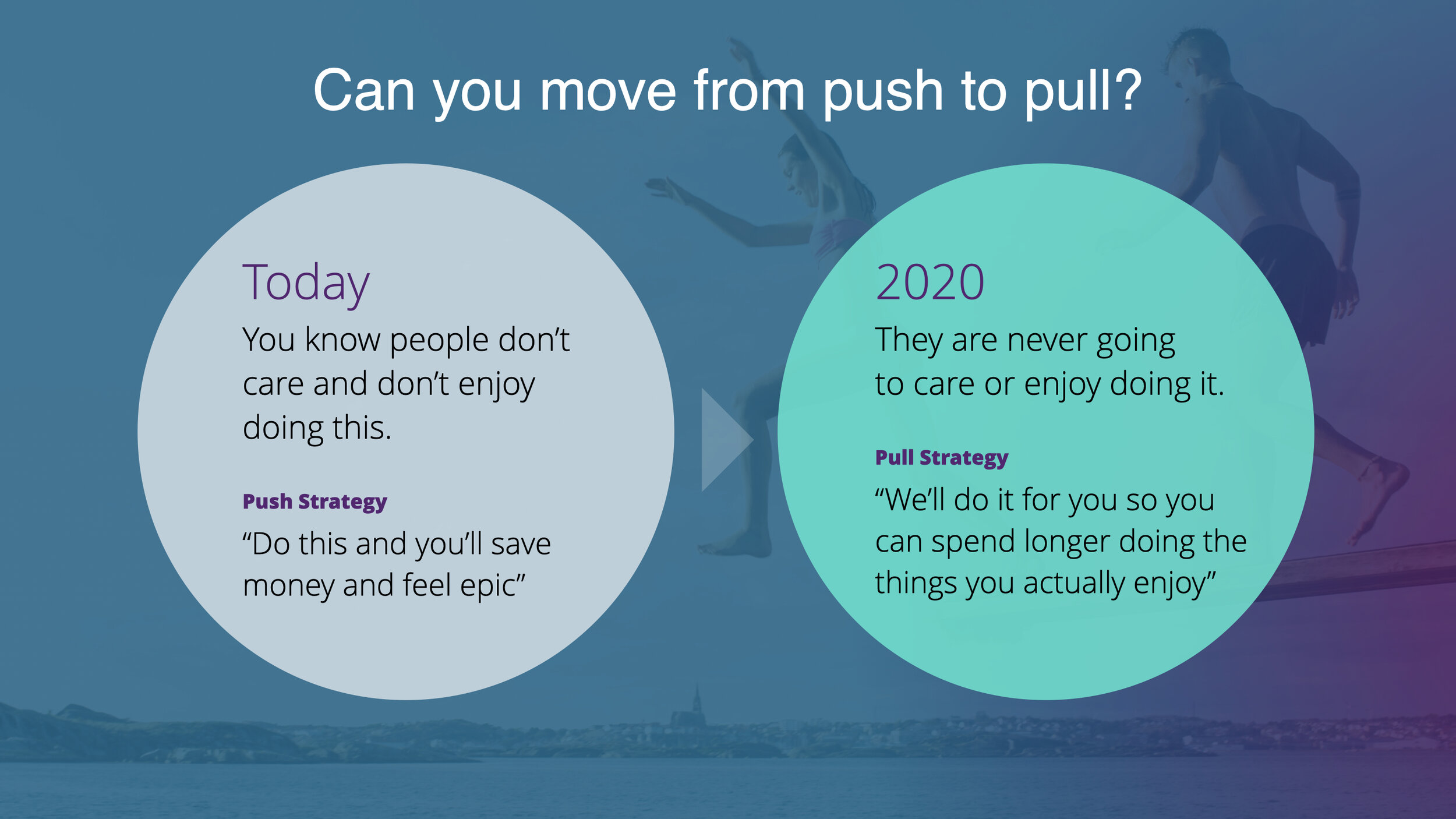

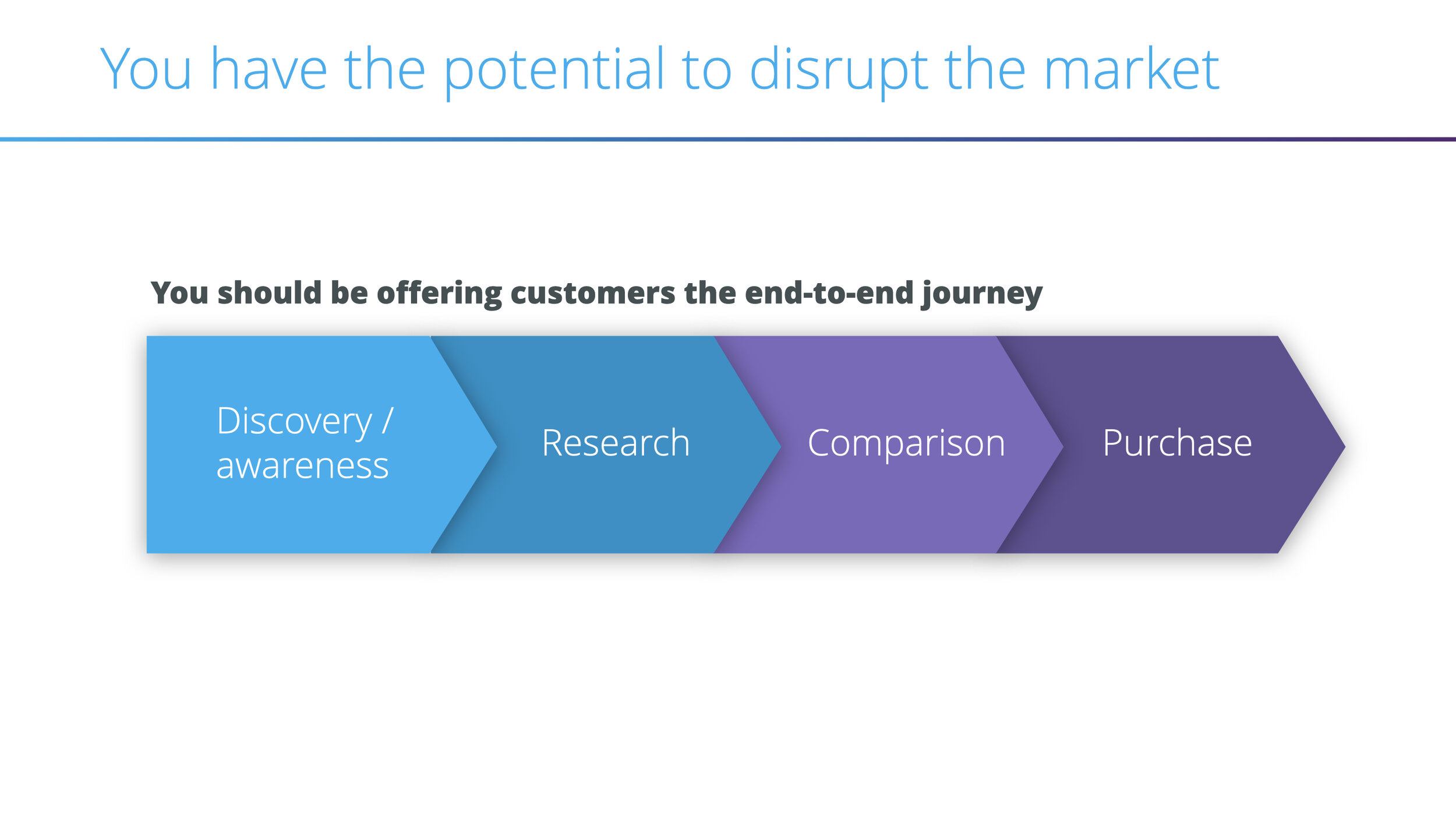

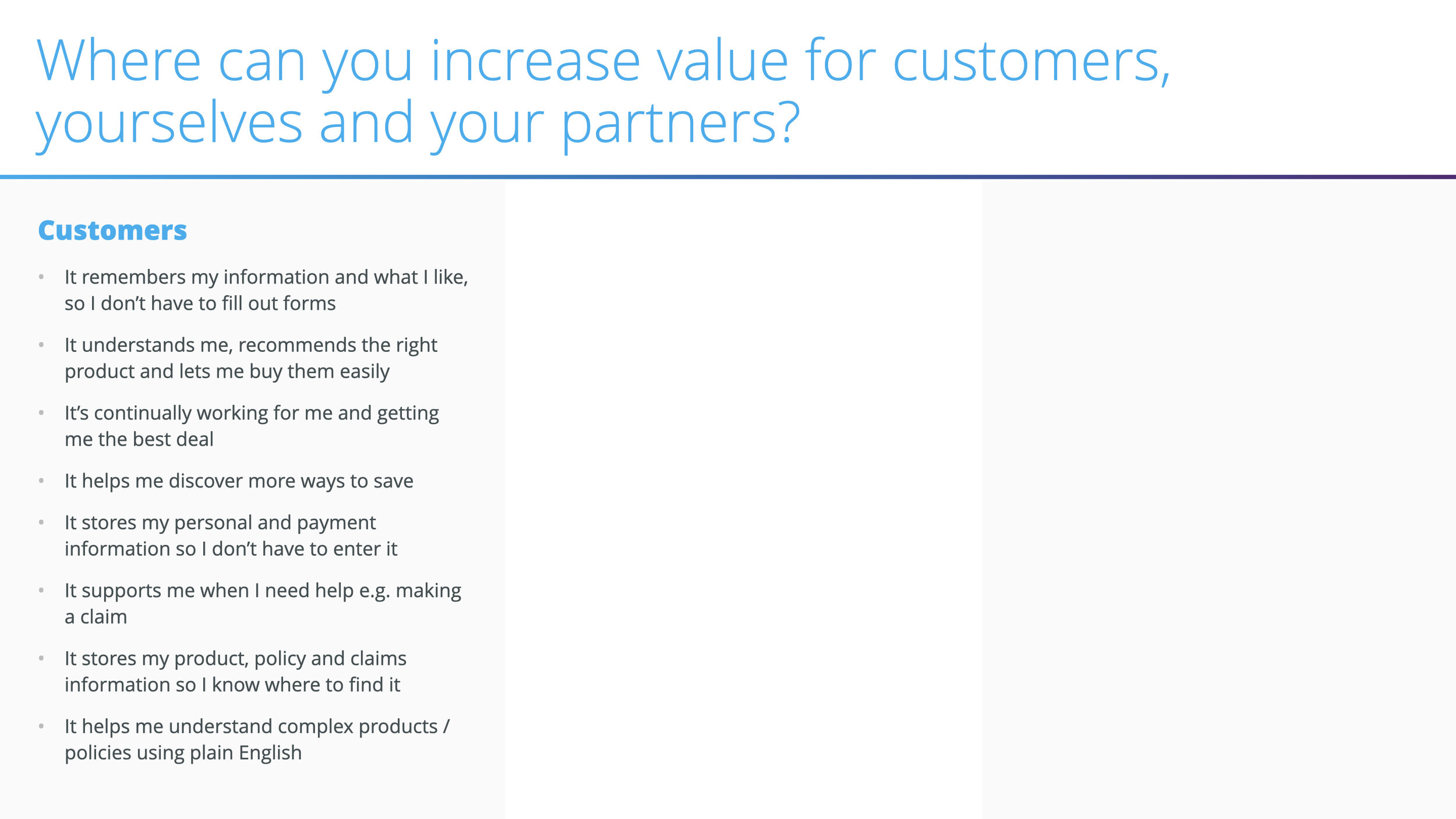

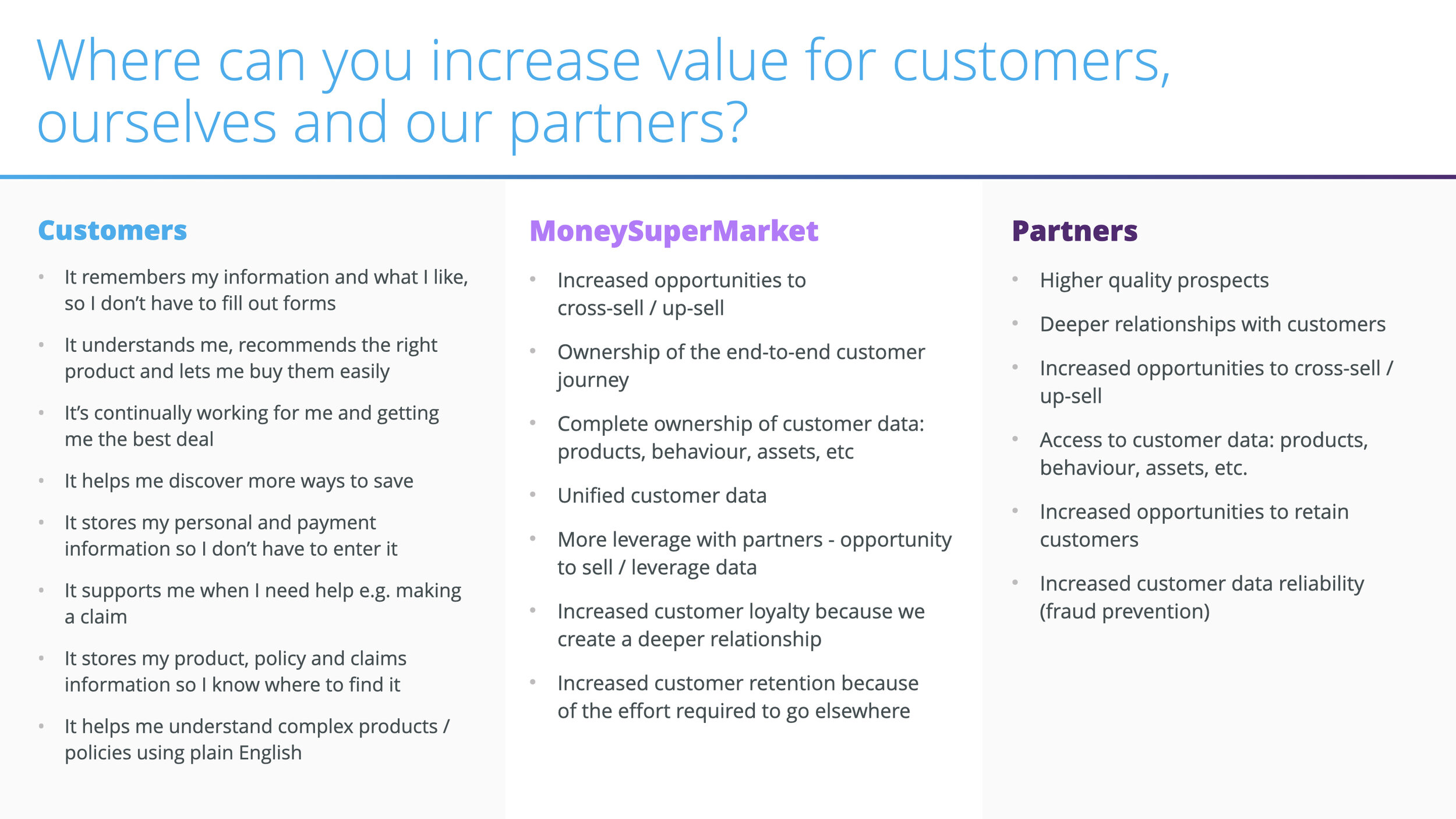

Next Beyond needed to evolve MSM’s value proposition from ‘saving’ people money to also helping them ‘manage’ and ‘grow’ their finances. What were customers’ pain points in these areas? How might we make it simple (even fun) to do this? What would be the key features and the best user journey for a MSM personal finance app that helped customers across their financial life?

As a result of our work MSM’s senior stakeholders agreed that evolving the company’s value proposition to encompass ‘managing’ and ‘growing’ finances was key. Feature concepts we designed and our rethought user journeys we based them upon were injected into MSM’s roadmap.

MY ROLE

Product Strategist: I was responsible for creating an evidence based projection of what the future of the price comparison market would look like in 3 years. I synthesised large amounts of research and then used strategic frameworks to clearly articulate: 1. Who is succeeding at helping people organise, save and grow their money? and how? 2. What is MSM’s brand USP that can be leveraged in the future? 3. What will customers want? 4. Where are the white spaces that MSM can exploit?

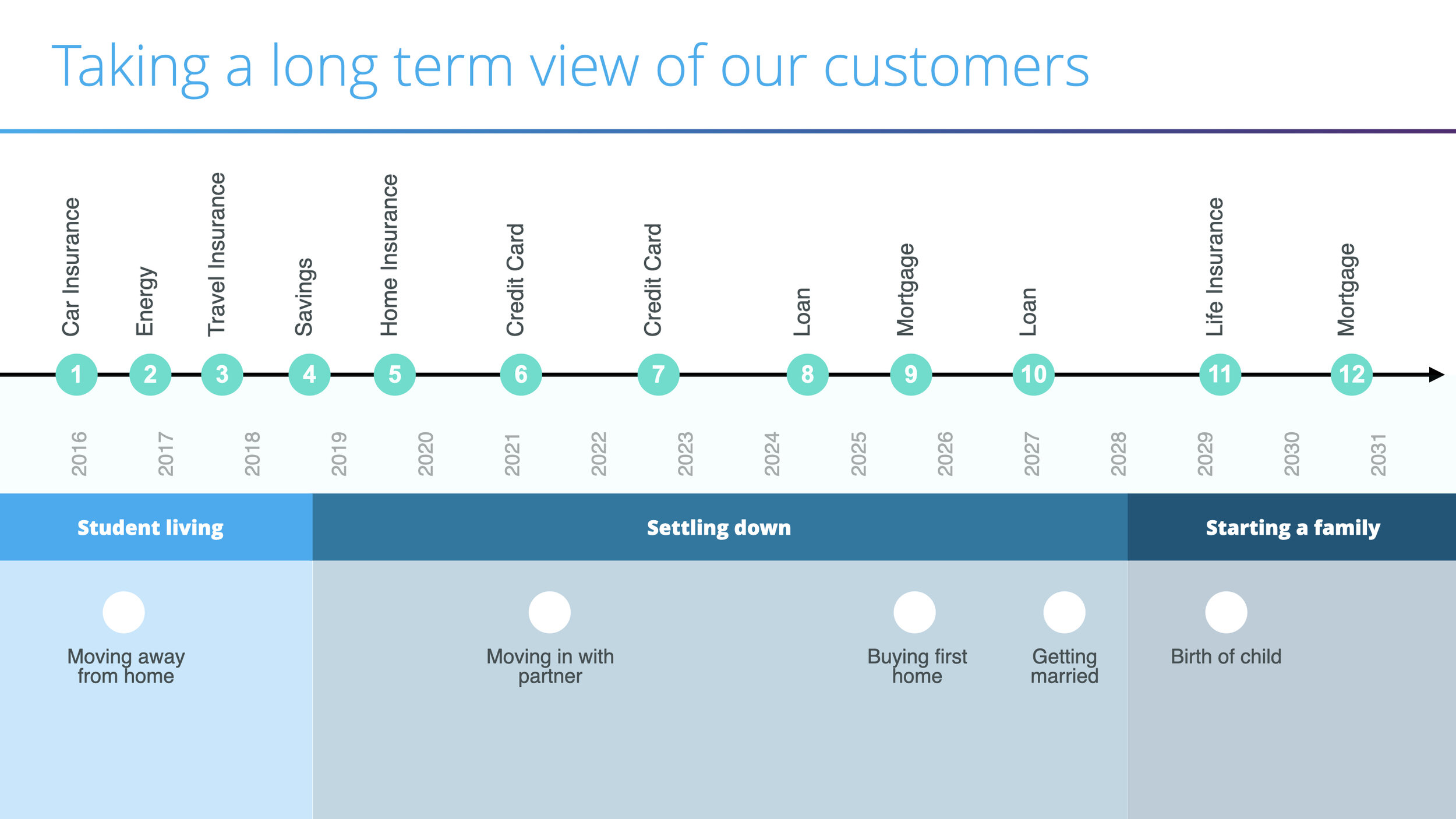

UX Researcher: I worked with UX to analyse hundreds of user interviews and remap the customer journey and pain points. We did this in a way MSM never had before by looking at a customer’s financial life across their entire lifespan and grouping policy renewals together.

Creative Facilitator: I designed and facilitated the applied creativity sessions (find out more here) in which created the concept features for MSM’s future mobile experience.

BACKGROUND

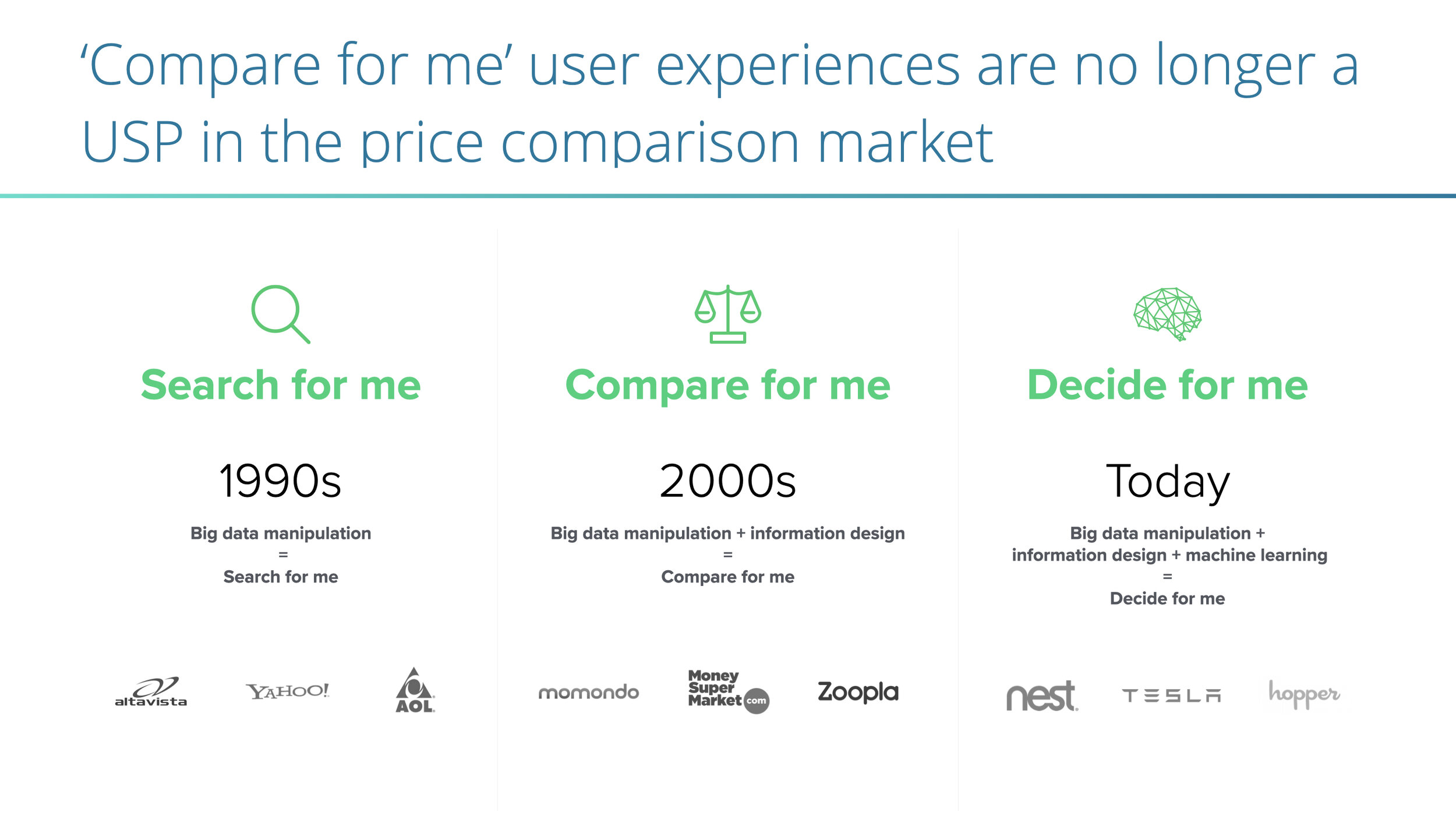

In the early 1990’s MoneySupermarket were the price comparison pioneers but over time competitors such as Compare The Market and Go Compare had saturated a market in which every brand offered a very similar user experience.

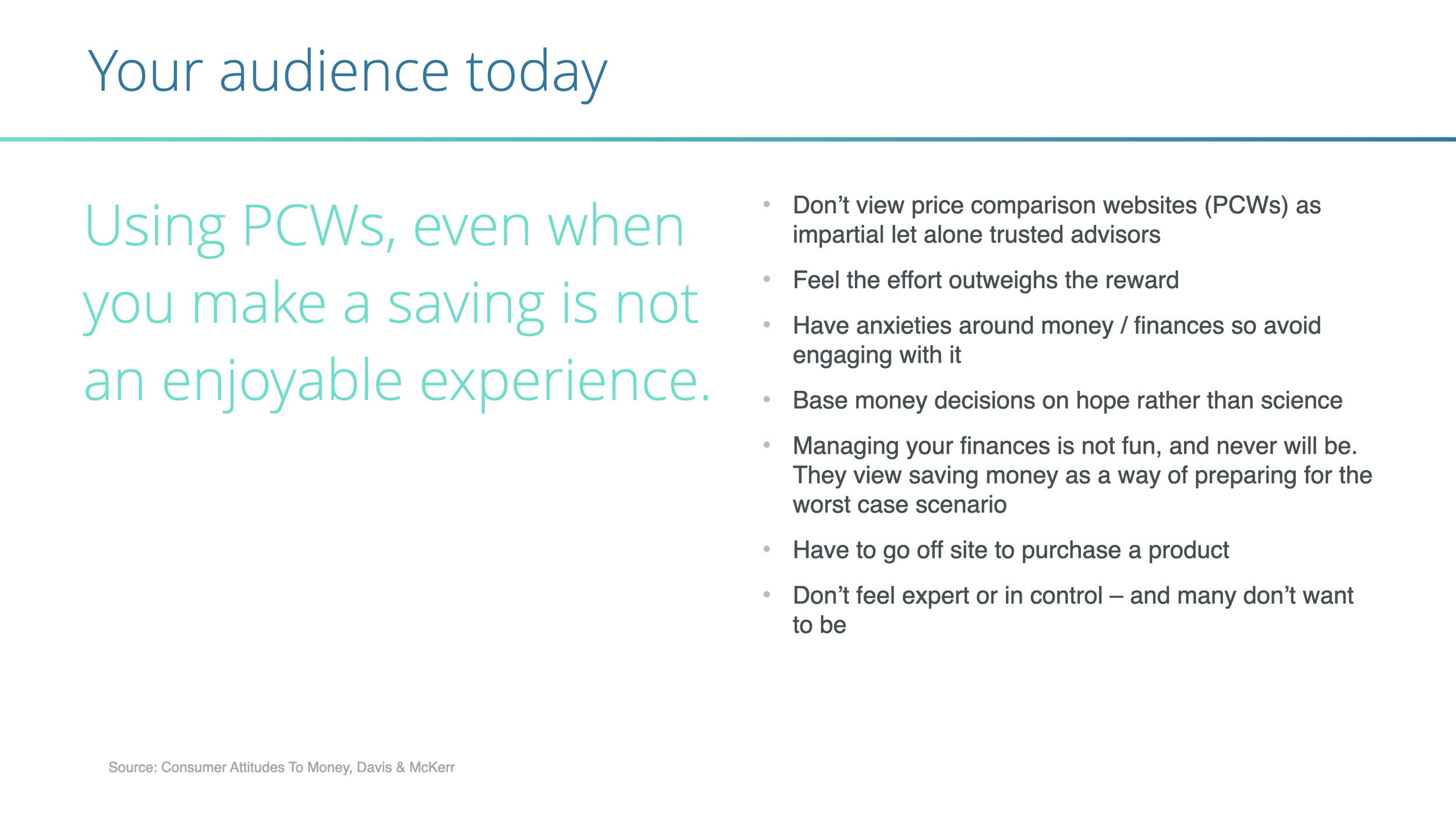

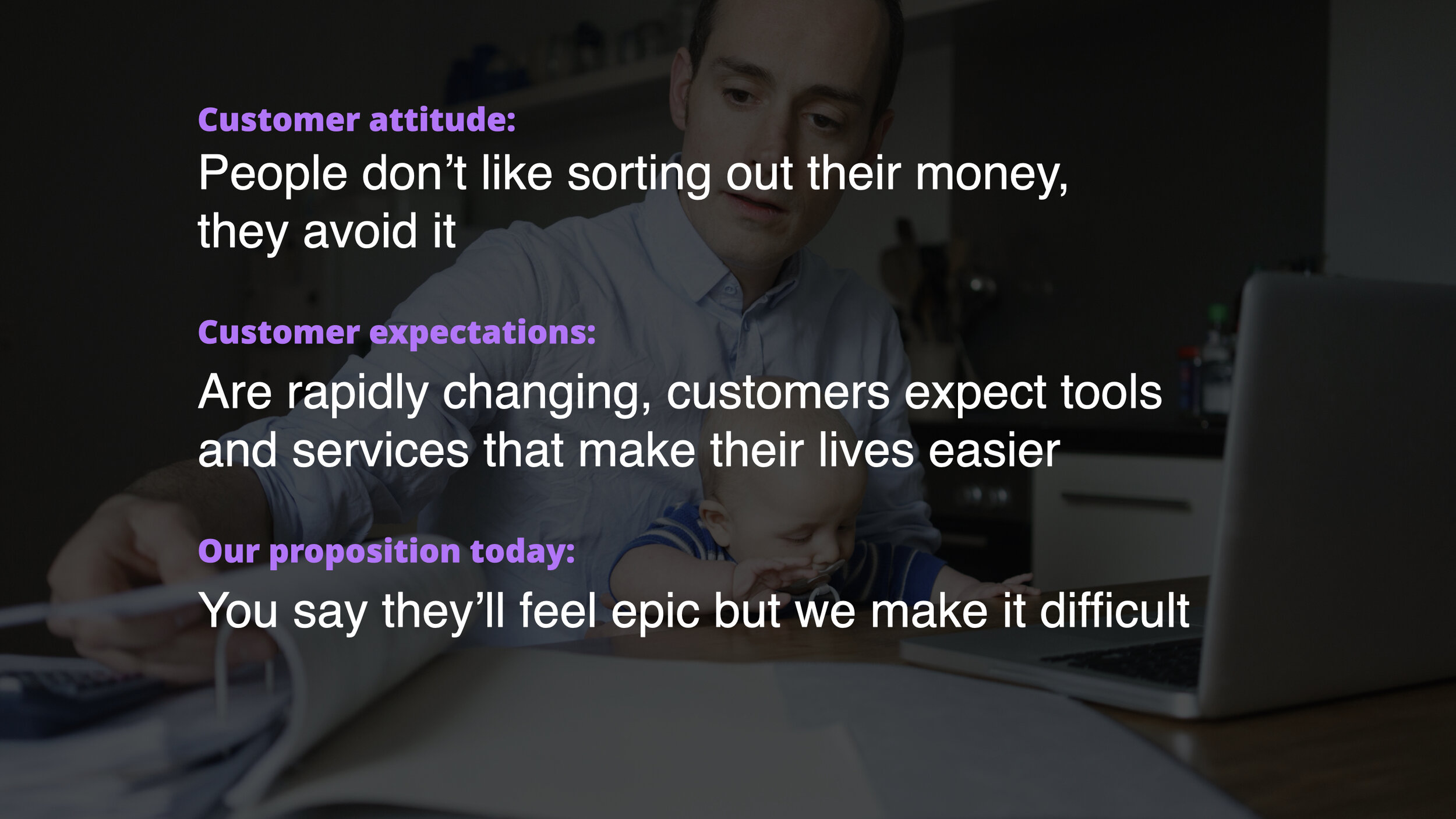

Customer’s trust in and loyalty to price comparison sites was low and fundamentally they found the task of renewing their insurance and financial policies complex and arduous.

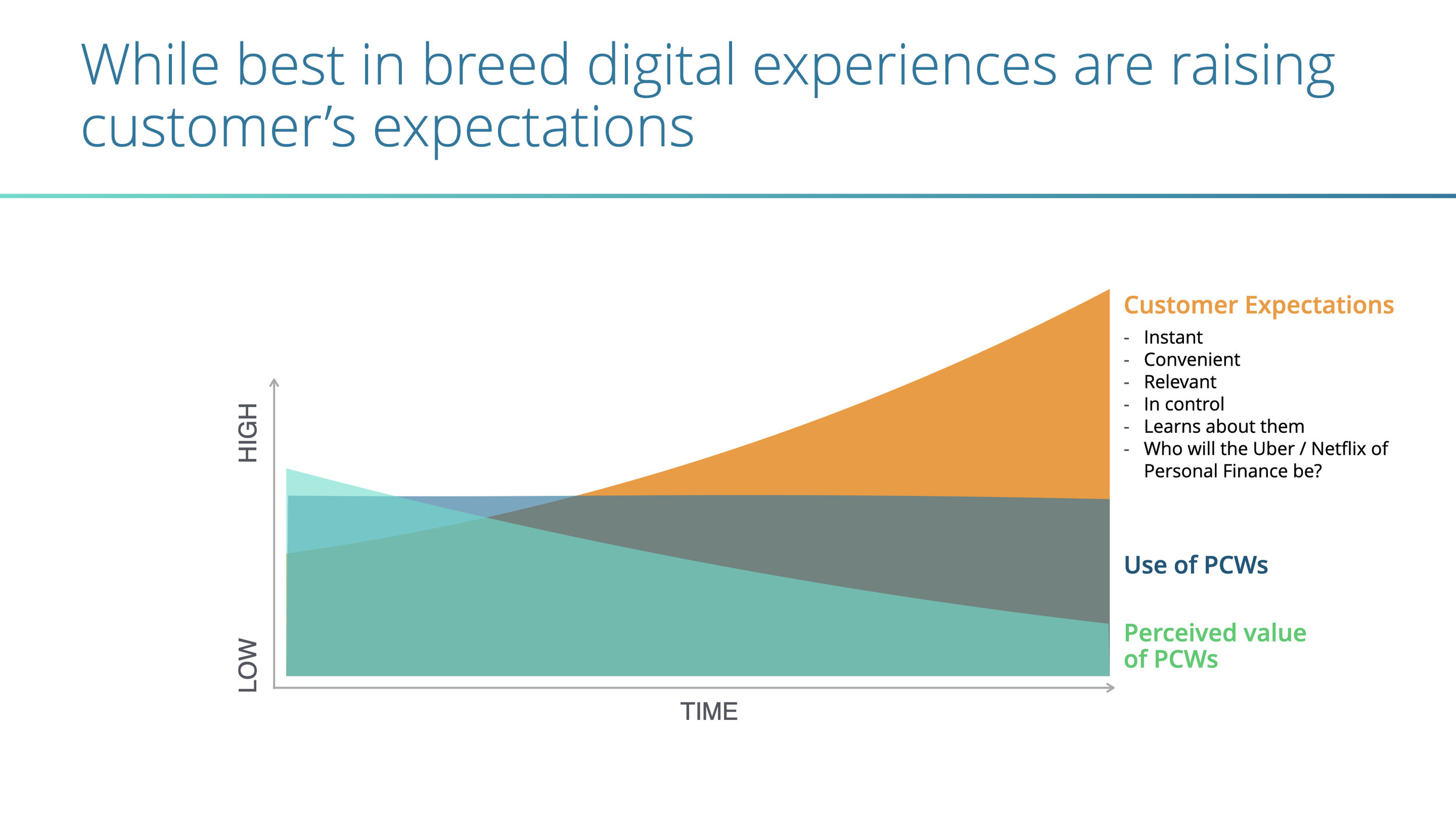

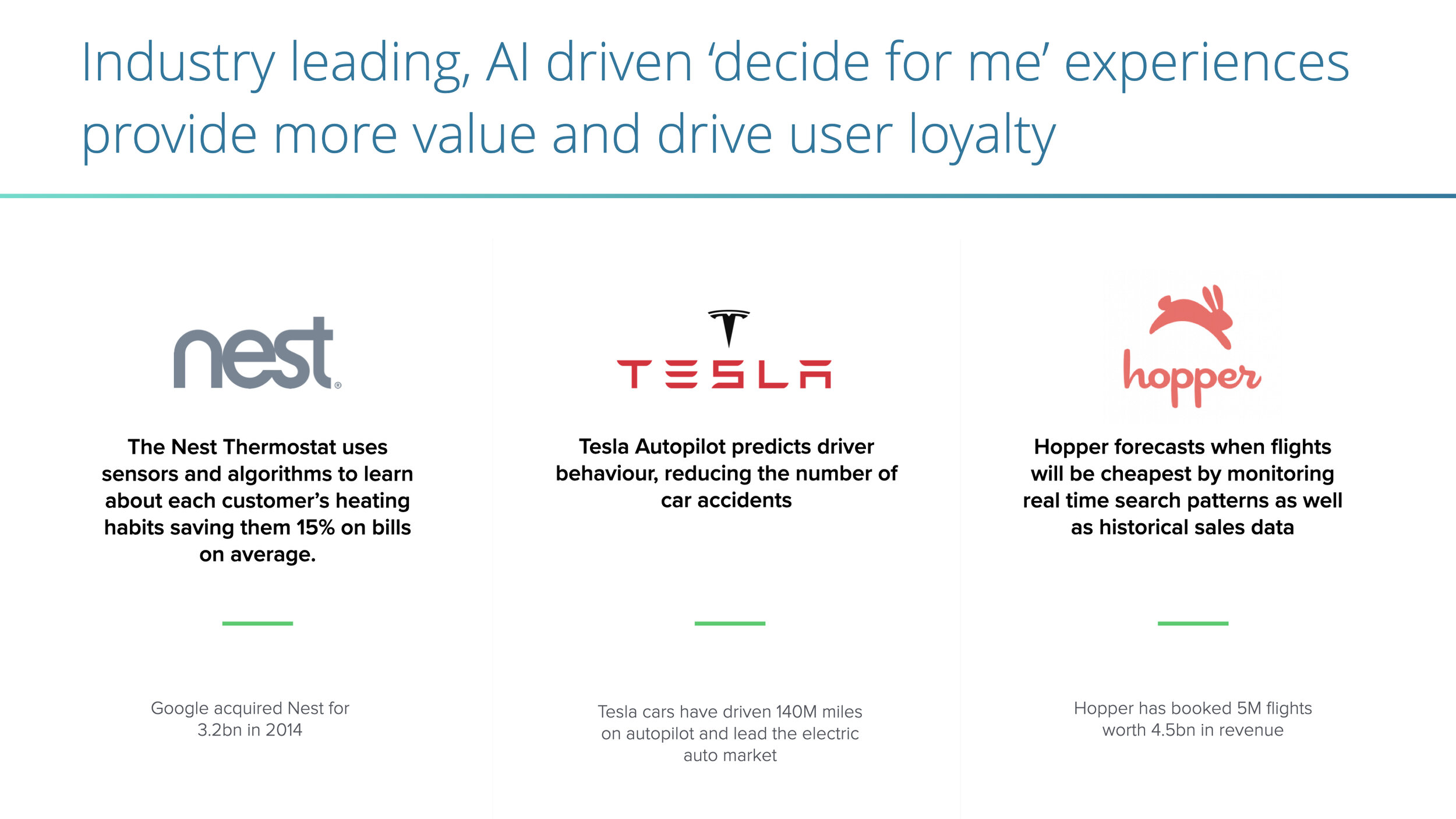

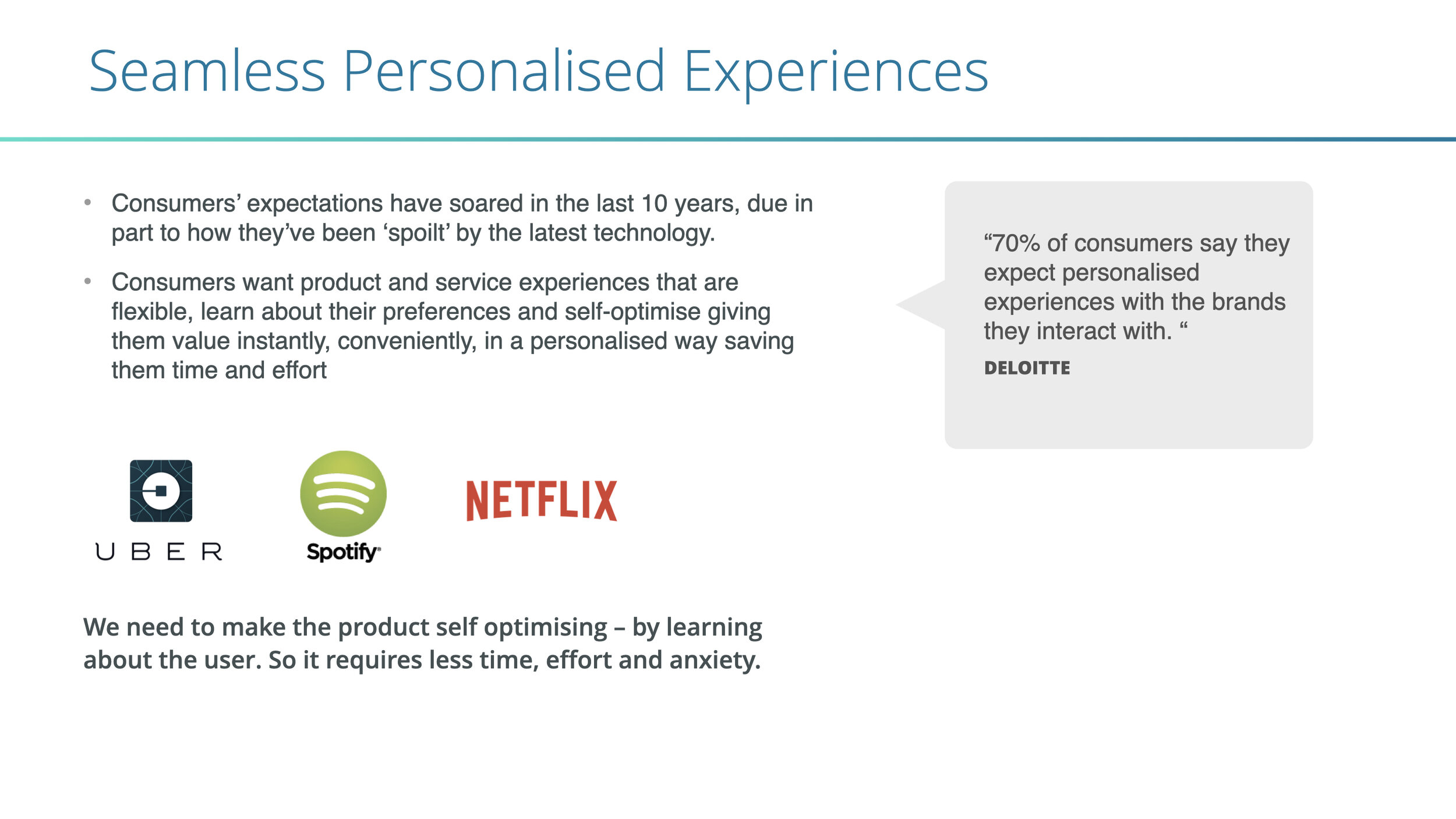

Customer’s expectations of digital experiences were at an all-time high with industry-leading companies like Netflix, Nest and Tesla creating seamless, intelligent and personalised platforms fuelled by machine learning.

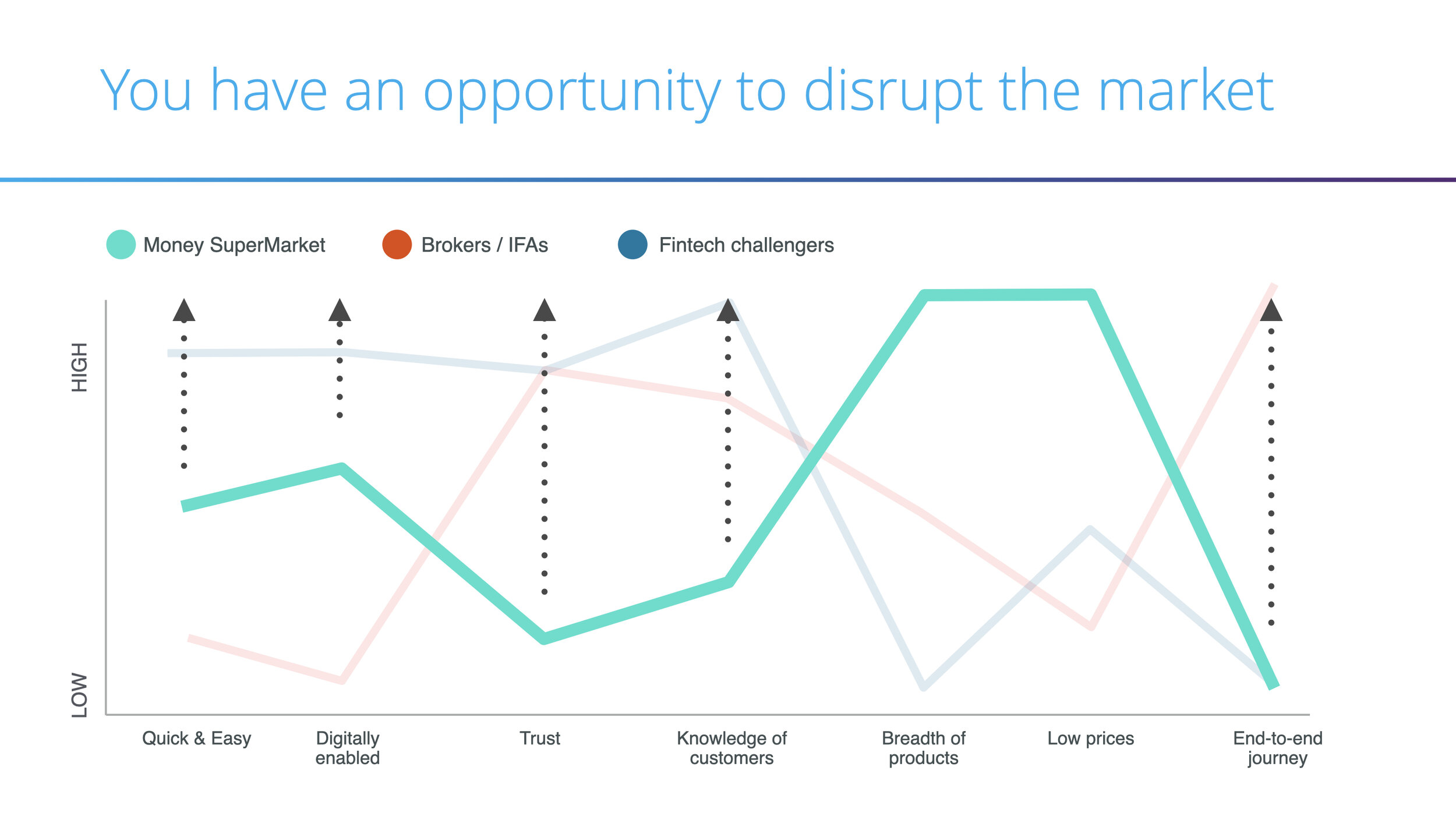

There was an opportunity for a fast-moving comparison site to capture market share by creating proactive recommendation and money-saving tools based on a deep understanding of their users that made saving money easy, trustworthy and effective.

THE BRIEF

MoneySupermarket asked us to look 3 years into the future and articulate a vision for their products and services that would meet customers' needs more effectively and truly fulfil the brand’s mission to ‘make people feel epic about saving money’.

We were also tasked with creating product visualisations that would inspire the business to commit to a programme of investment to turn that vision into a reality.

Our output would be used to engage stakeholders & employees, and enable the product team to demonstrate the scale of their ambition and take the first steps towards delivering the new service.

DEFINING THE PROBLEM:

We created a framework that allowed us to make some justifiable predictions about how the future might look. We wanted to visualise the world in 5 years time to provide the context within which we could visualise MSM’s market leading offering. We looked at the future within three categories:

The Market: Which companies are at the cutting edge when it comes to helping people save money?

MSM’s Brand: How can MSM’s core mission to save money for their customers be extrapolated in the future?

Customer Needs: What are the key trends that are evolving customer needs and increasing expectations?

Part 1: Your market Position

We looked at the 3 core jobs customers are thinking about when it come to their finances:

Managing my money

Growing my money

Saving my money

We then looked for companies at the cutting edge who were successfully servicing these needs. We looked for commonalities in the way they operated and how they thought about their customers.

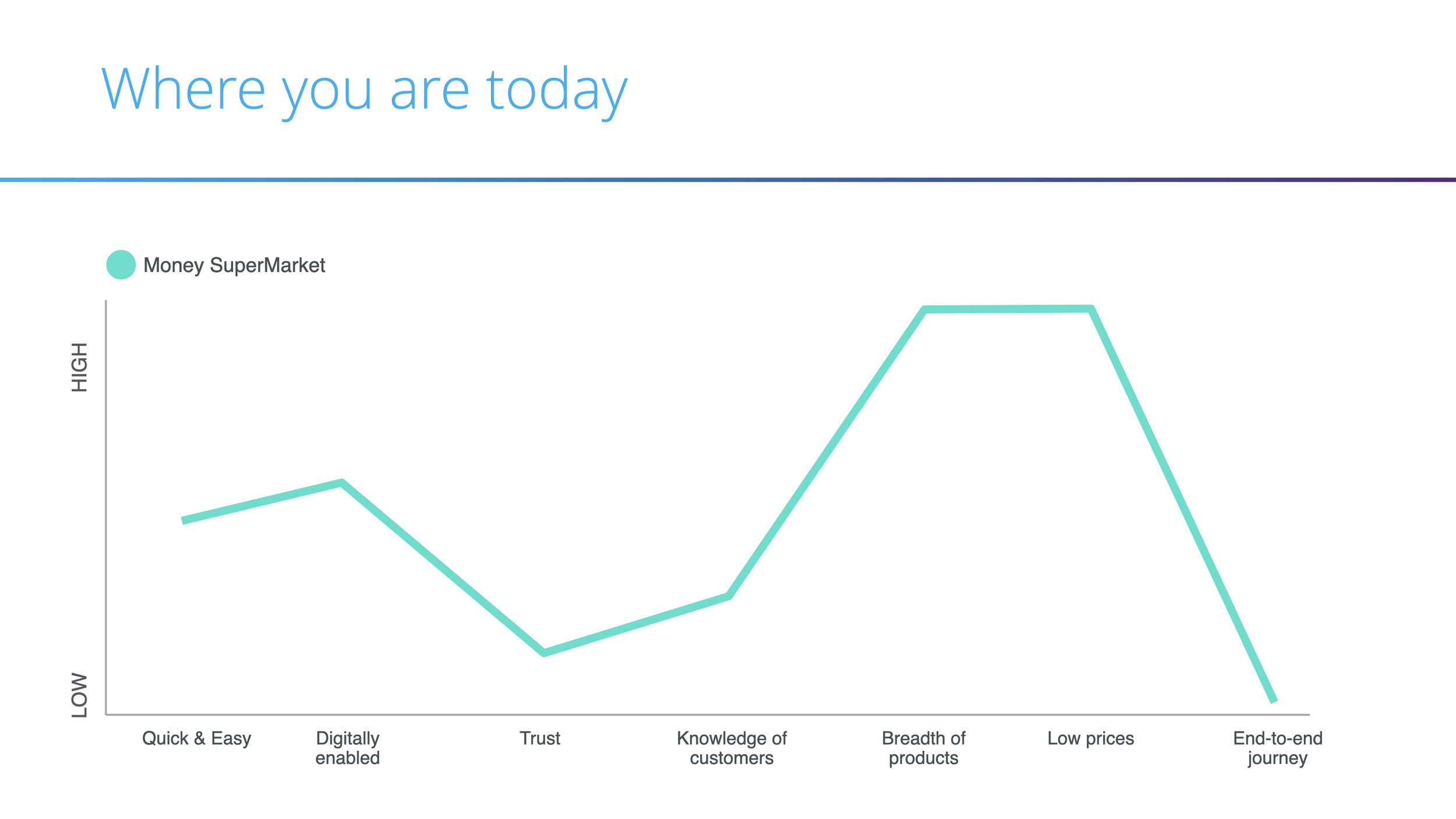

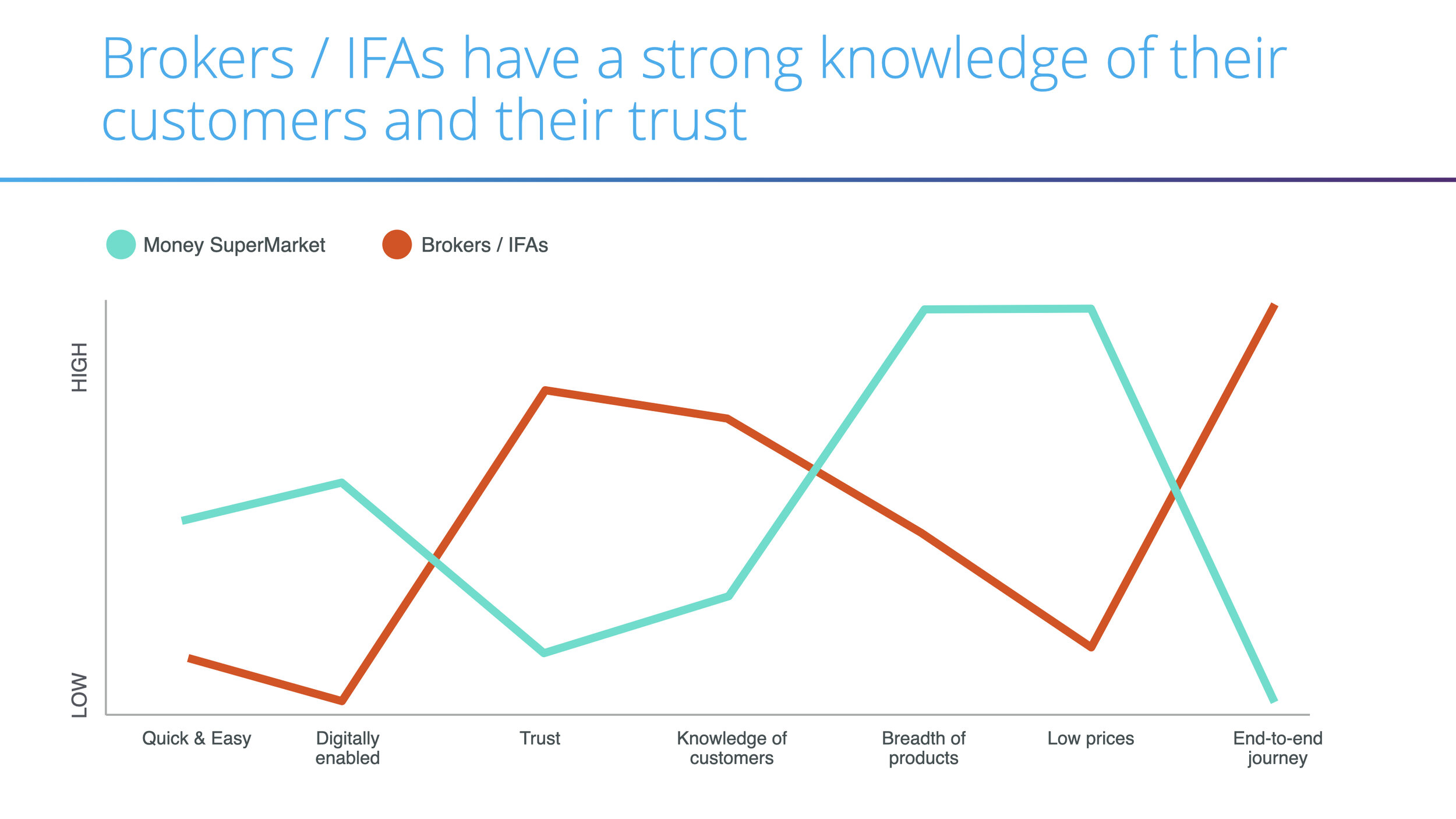

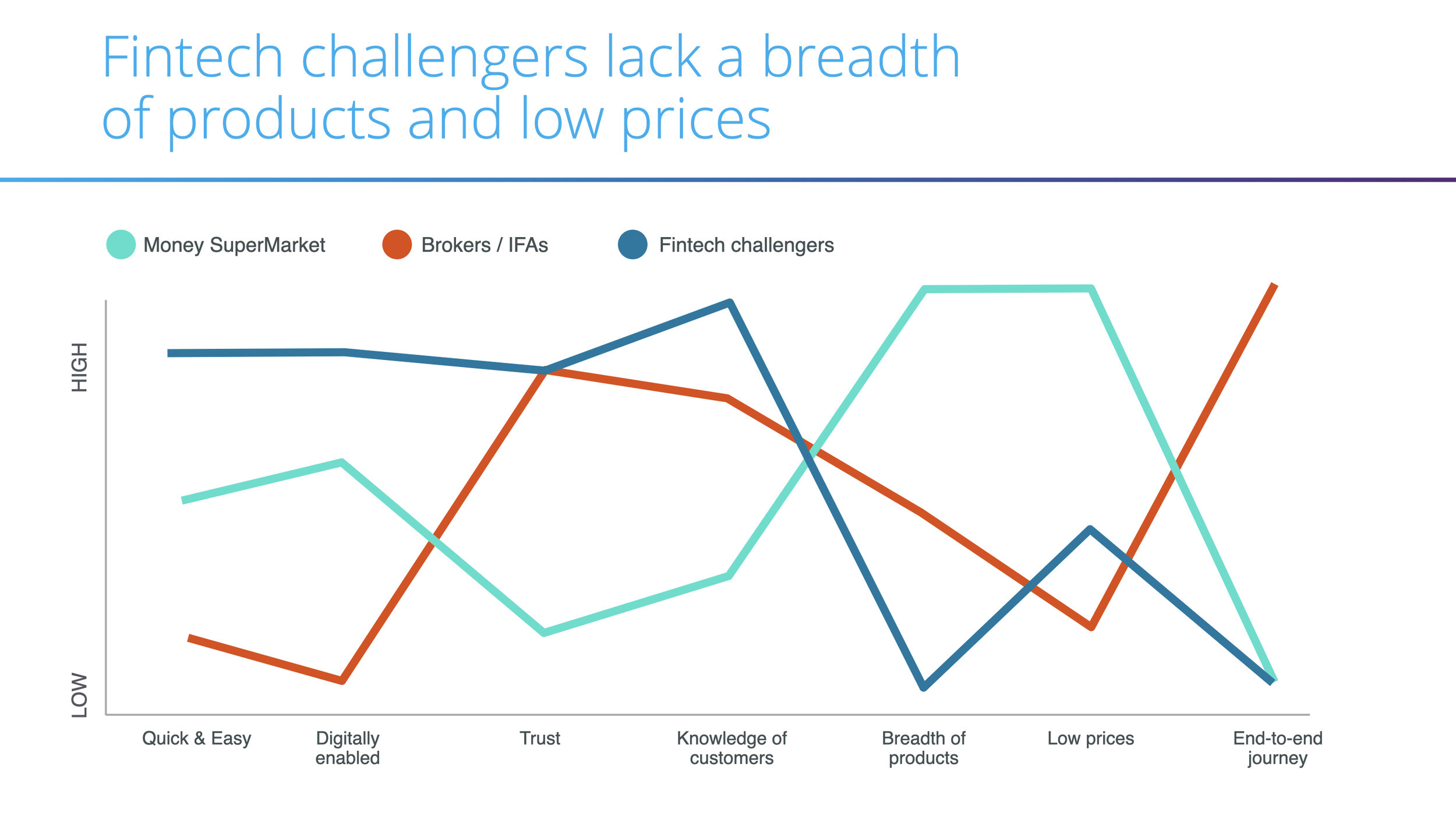

We also used a Blue Ocean Strategy approach to dissect the key value propositions that made a personal finance service successful or unsuccessful (for example ‘trust’, ‘quick & easy’, ‘low prices’, ‘knowledge of customers’…..) This helped us understand the competitive landscape in a simple visual way and identify white space opportunities that current services were neglecting.

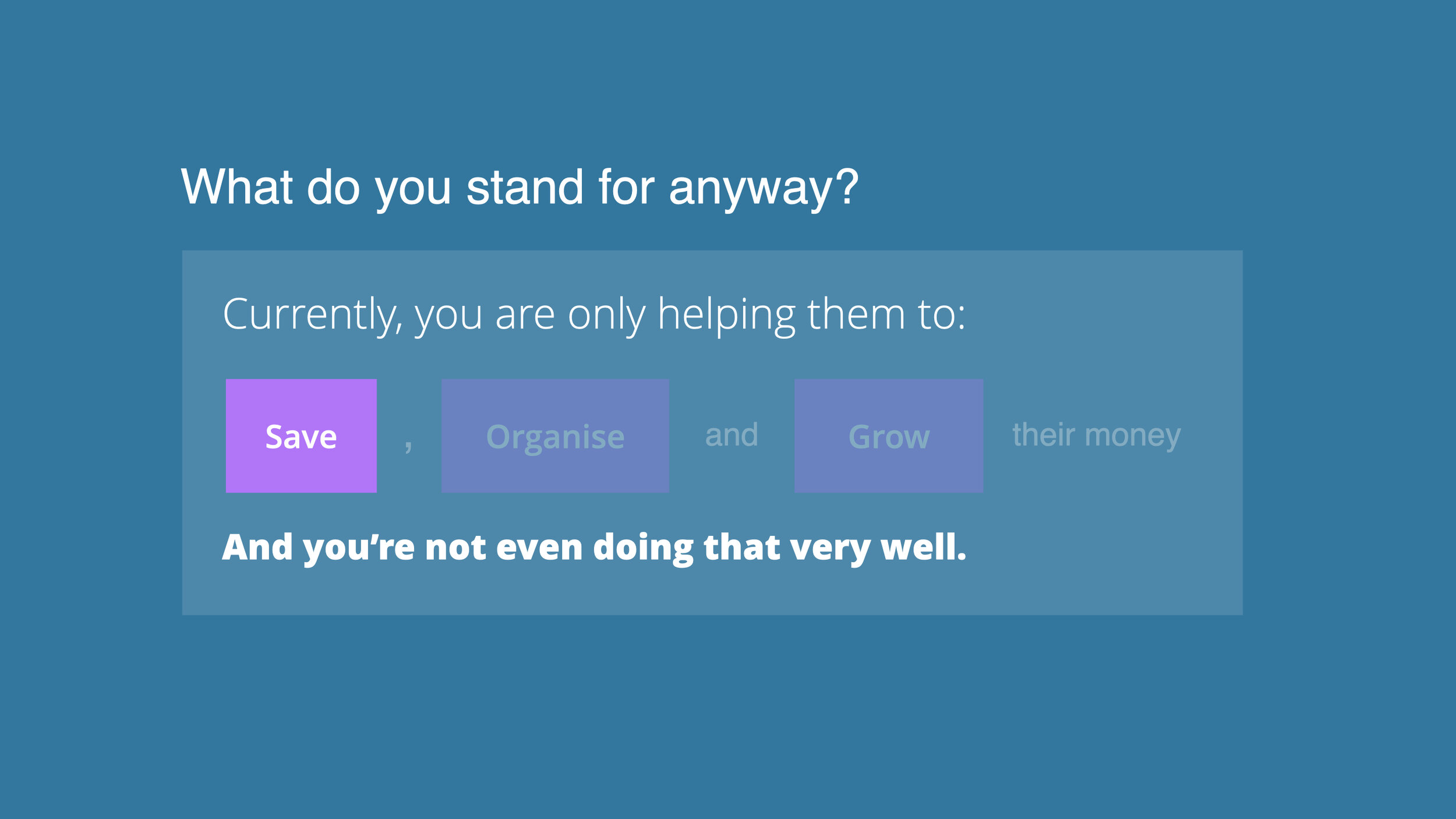

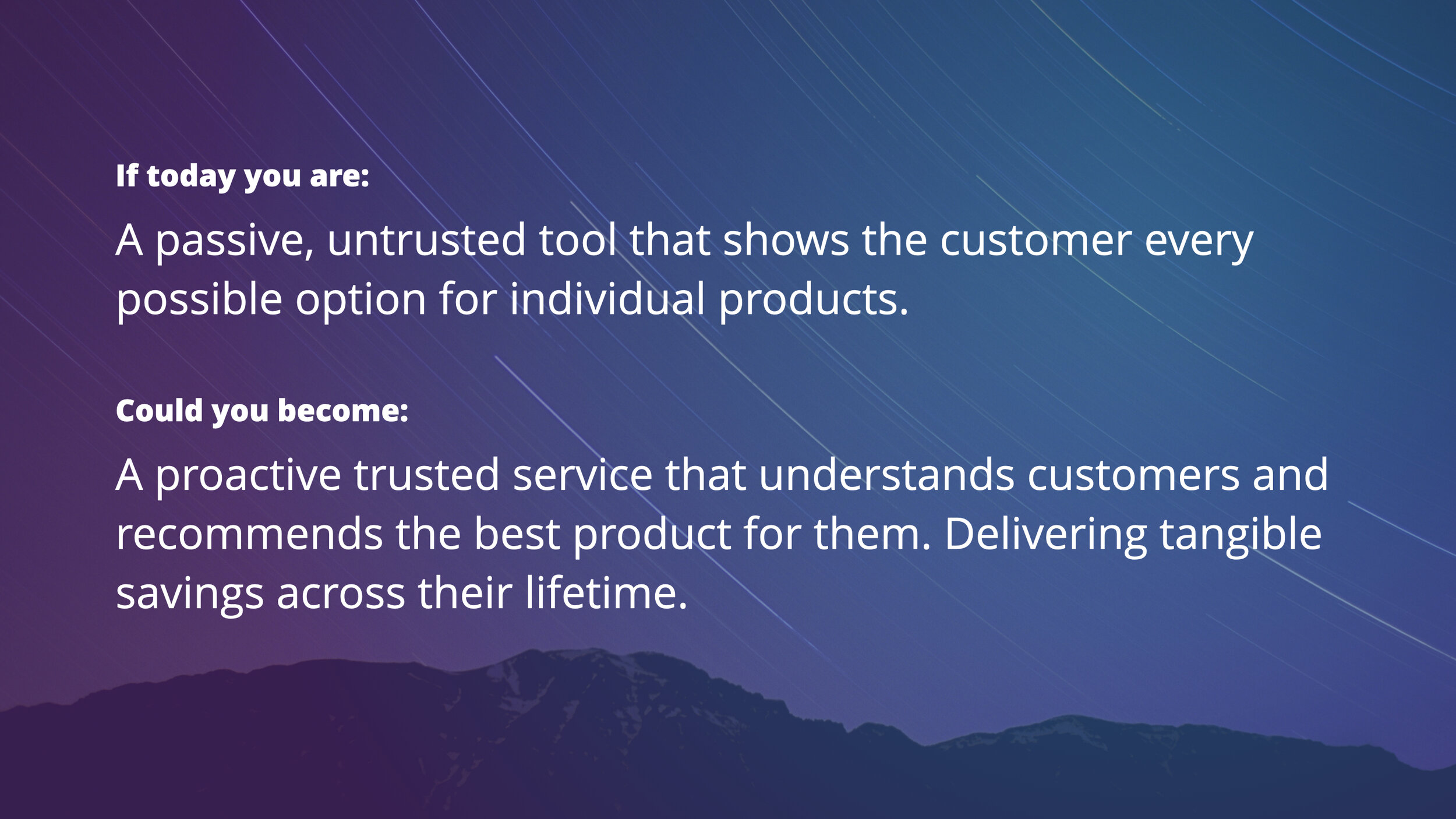

Part 2: Current brand Proposition / Vision

We looked at MSM’s promise and vision to ‘make people feel epic about saving money’ and scrutinised their current offering to see in which ways it failed to truly deliver on that promise.

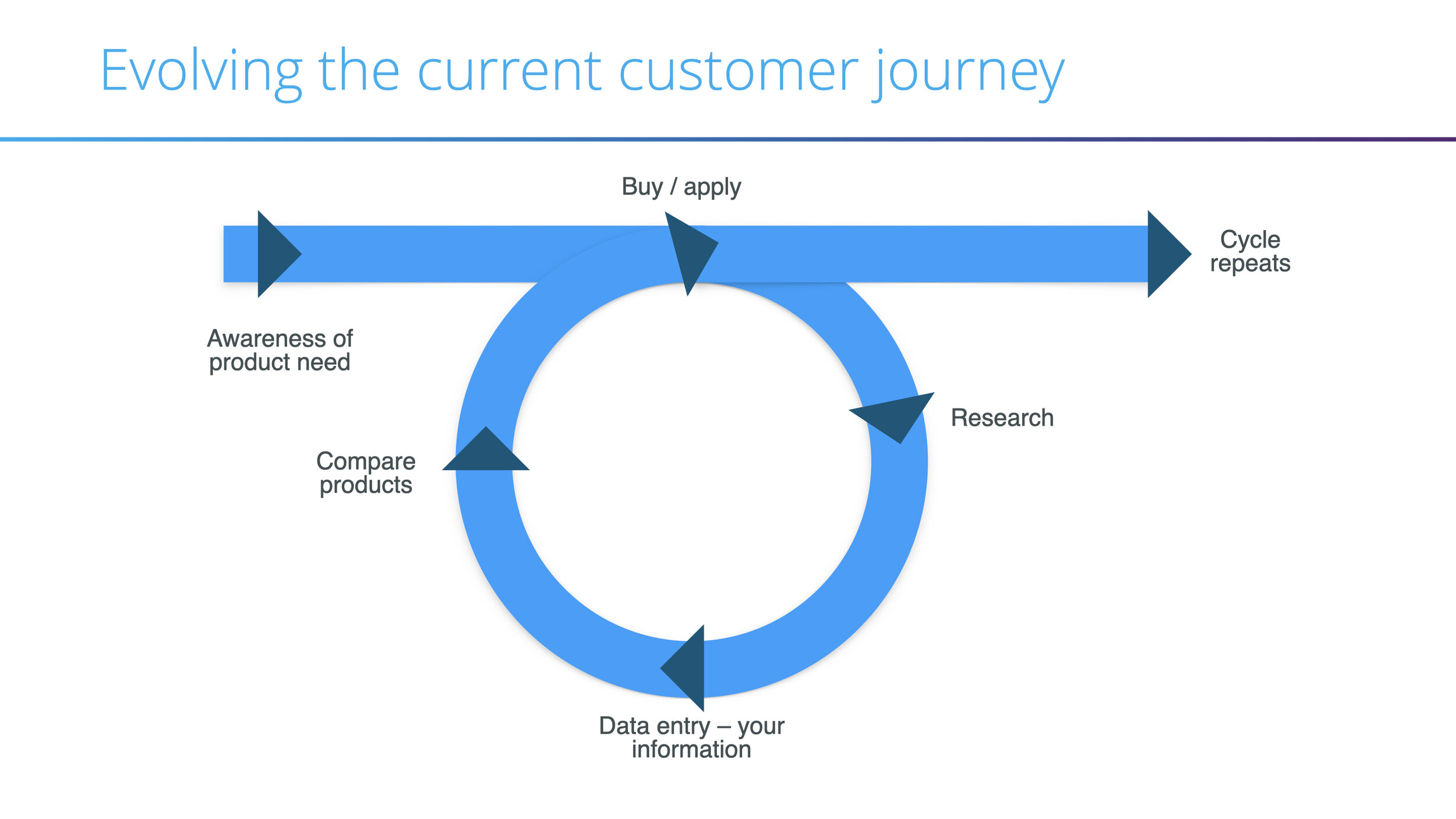

To do this we dissected and mapped the full customer journey based on user interviews and MSM’s own extensive research. This allowed us to identify all the pain points each customer had in their money saving journey and the stages they went through.

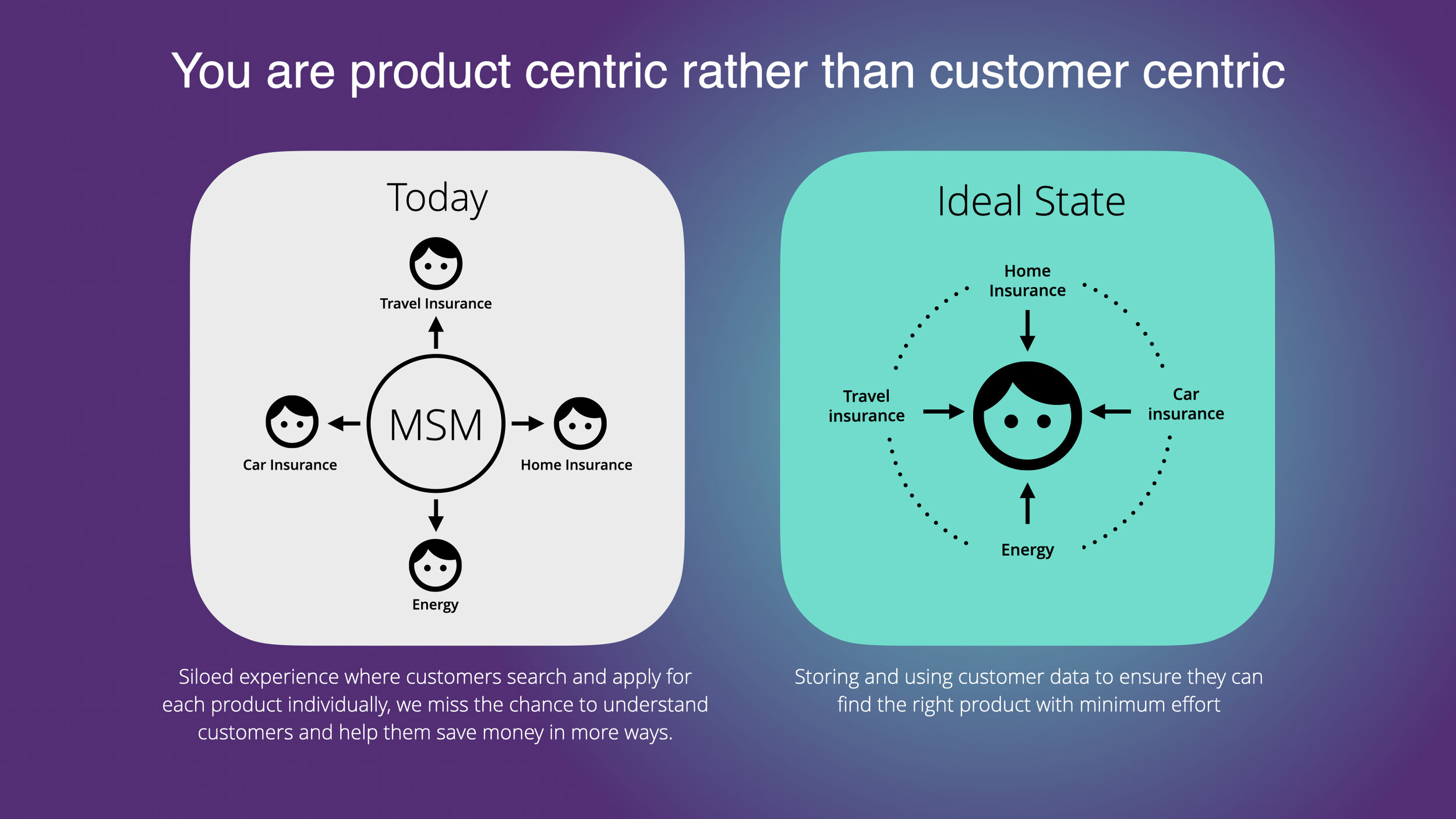

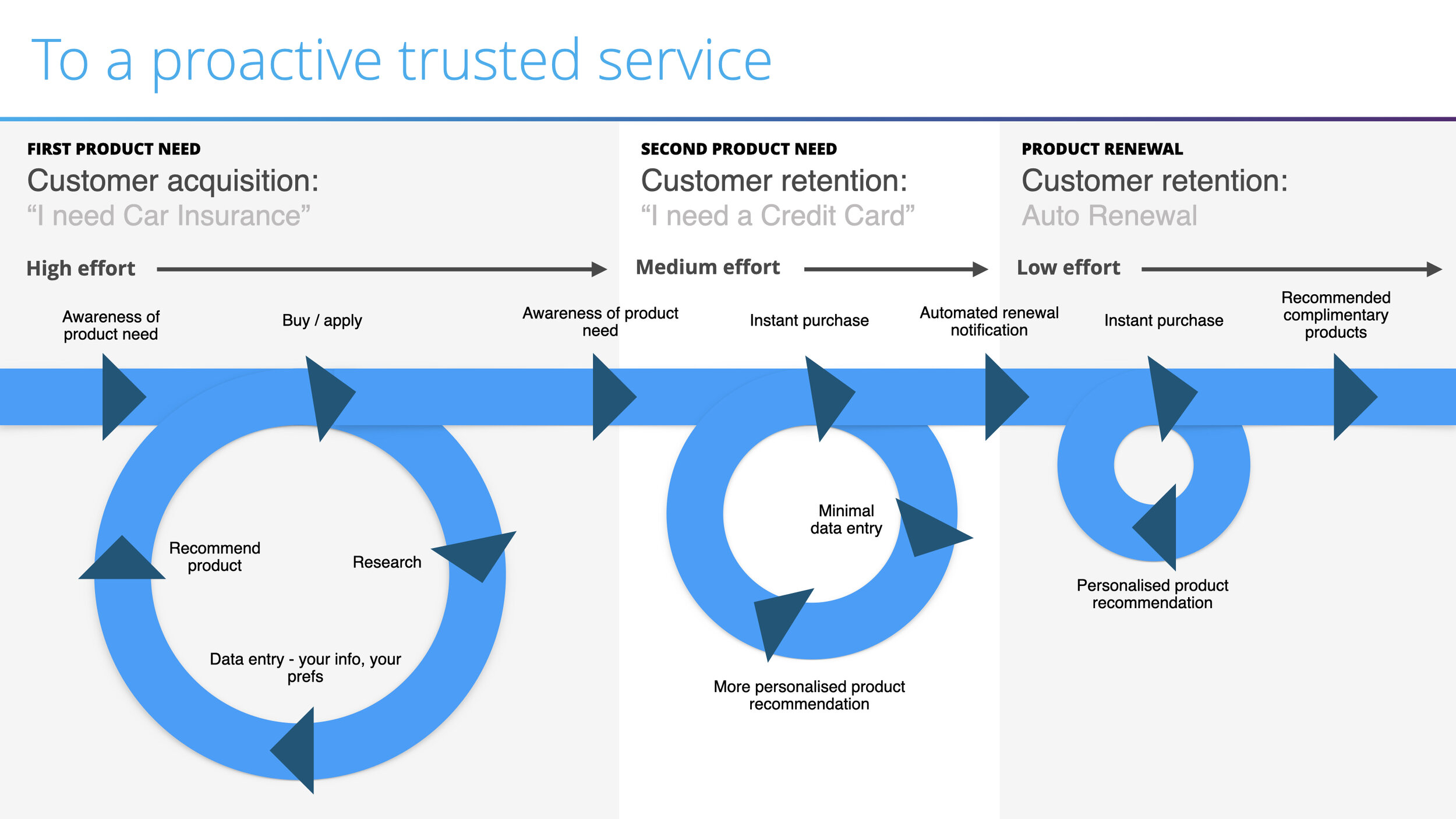

Rather than looking at ‘Credit Card Applications’, ‘Home Insurance Renewals’ or ‘Energy Provider Comparison’ as separate jobs, we explored the concept that these tasks were part of user’s larger ‘financial life’ with each task becoming more or less relevant at certain times and life stages (like buying your first house, having your first child etc.) By taking this more holistic approach we could help MSM see all the opportunities to make their product more personalised, relevant and integrated for the user throughout their life time.

The ideal comparison service should already know all the fundamental information about you and your family so deals should be tailored accordingly and you should never need to re-enter your personal details. This service should be proactive, predicting your upcoming needs and types of services you might be looking for based on an understanding of you, your life stage and other people like you.

Part 3: Customer needs today and in 3 year’s time

We looked at MSM’s promise and vision to ‘make people feel epic about saving money’ and scrutinised their current offering to see in which ways it failed to truly deliver on that promise.

To do this we dissected and mapped the full customer journey based on user interviews and MSM’s own extensive research. This allowed us to identify all the pain points each customer had in their money saving journey and the stages they went through.

Rather than looking at ‘Credit Card Applications’, ‘Home Insurance Renewals’ or ‘Energy Provider Comparison’ as separate jobs, we explored the concept that these tasks were part of user’s larger ‘financial life’ with each task becoming more or less relevant at certain times and life stages (like buying your first house, having your first child etc.) By taking this more holistic approach we could help MSM see all the opportunities to make their product more personalised, relevant and integrated for the user throughout their life time.

CREATING THE SOLUTION

Part 1: Updated Product Vision & System Principles

Our research within the discovery phase helped us develop a product vision that truly fulfilled MSM’s mission to help customer’s save, organise and grow their money.

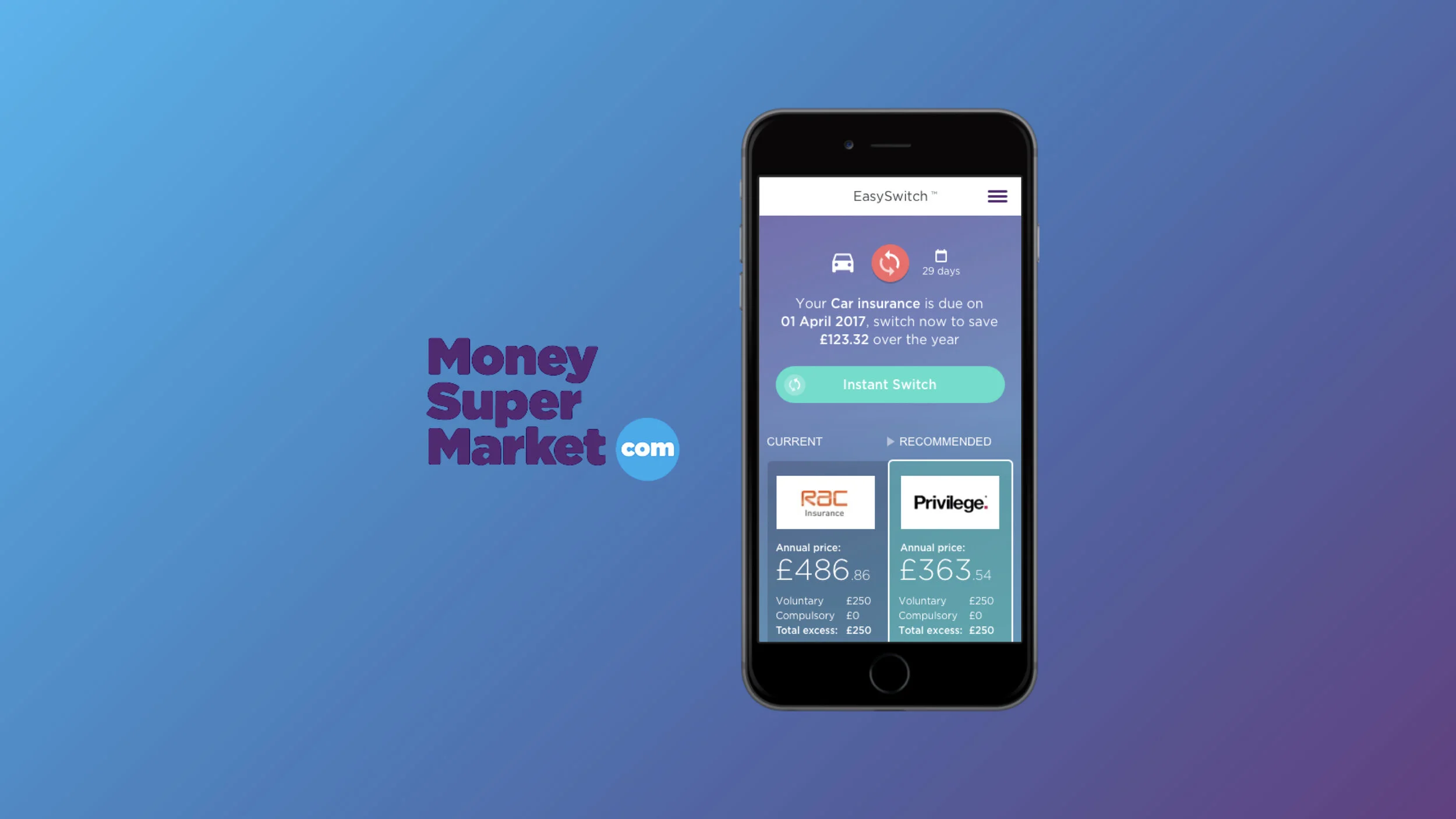

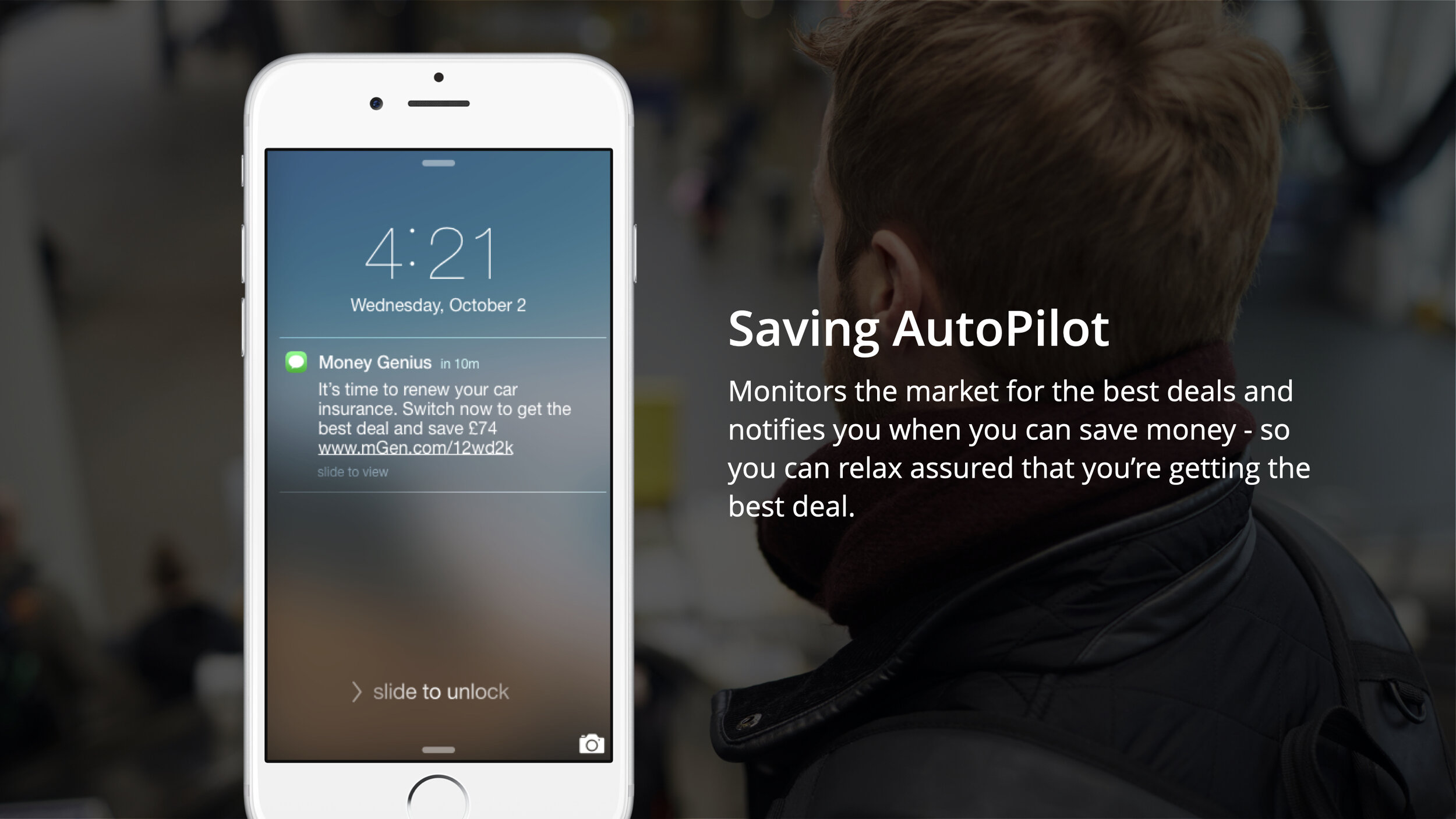

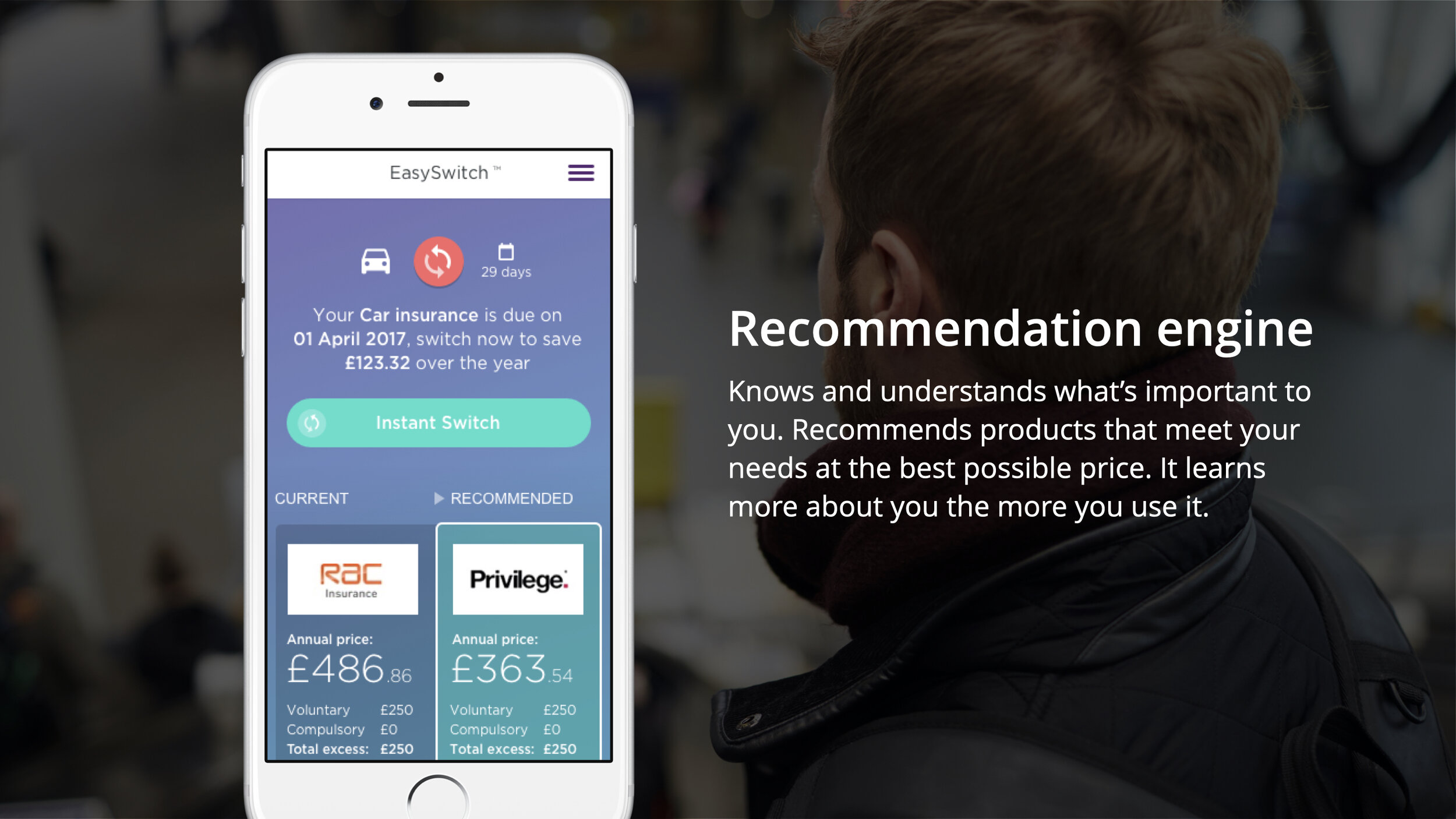

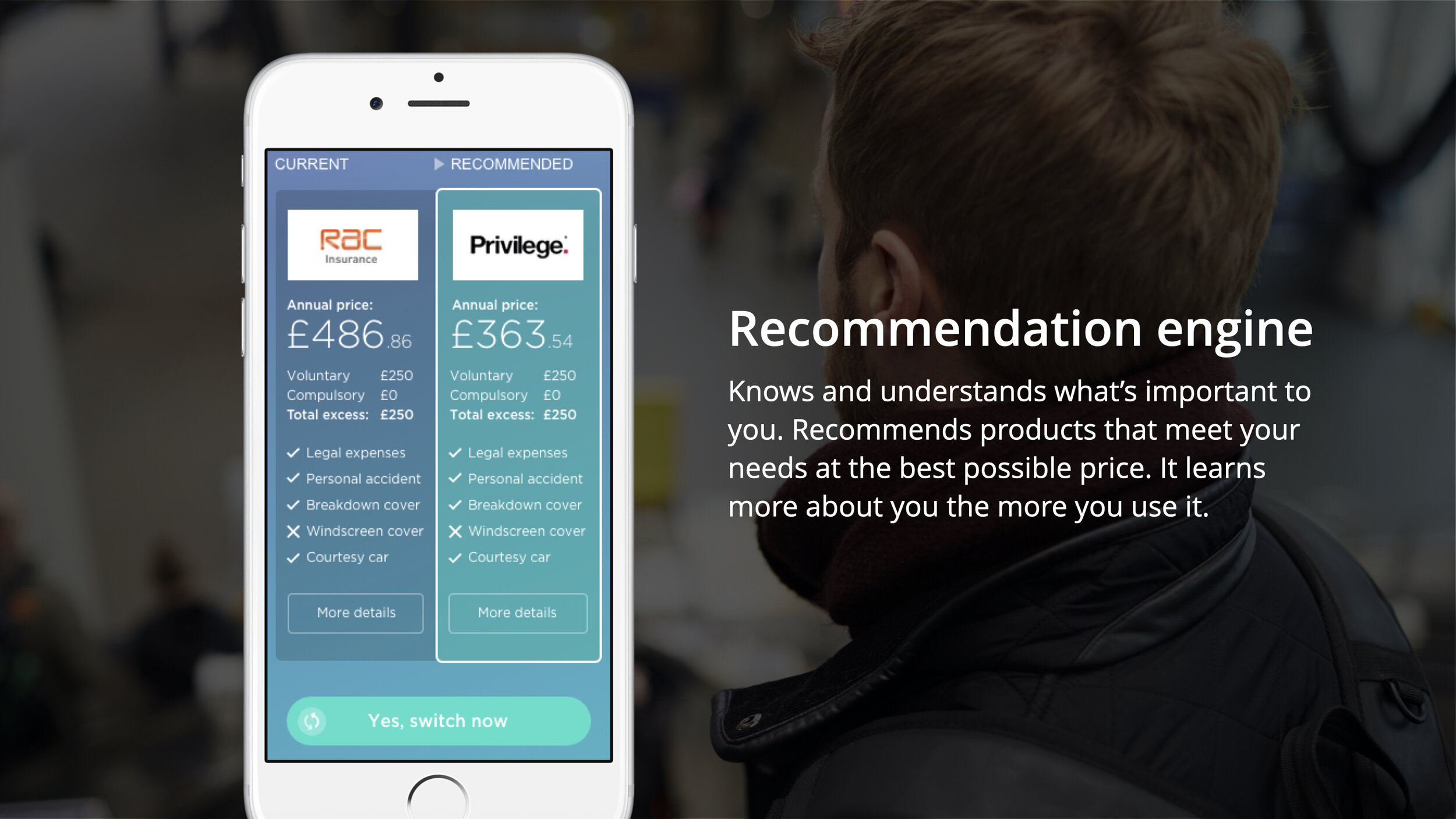

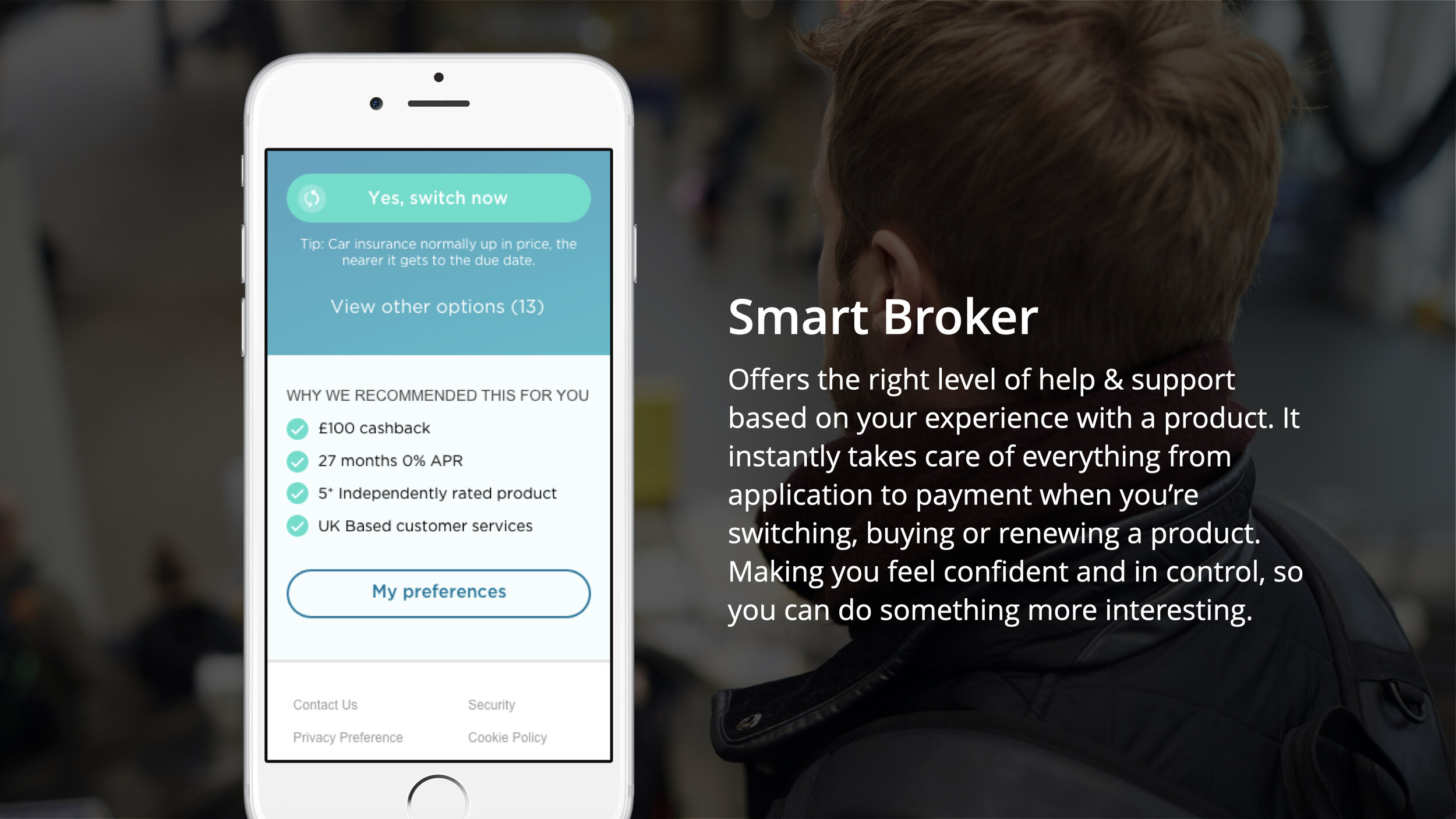

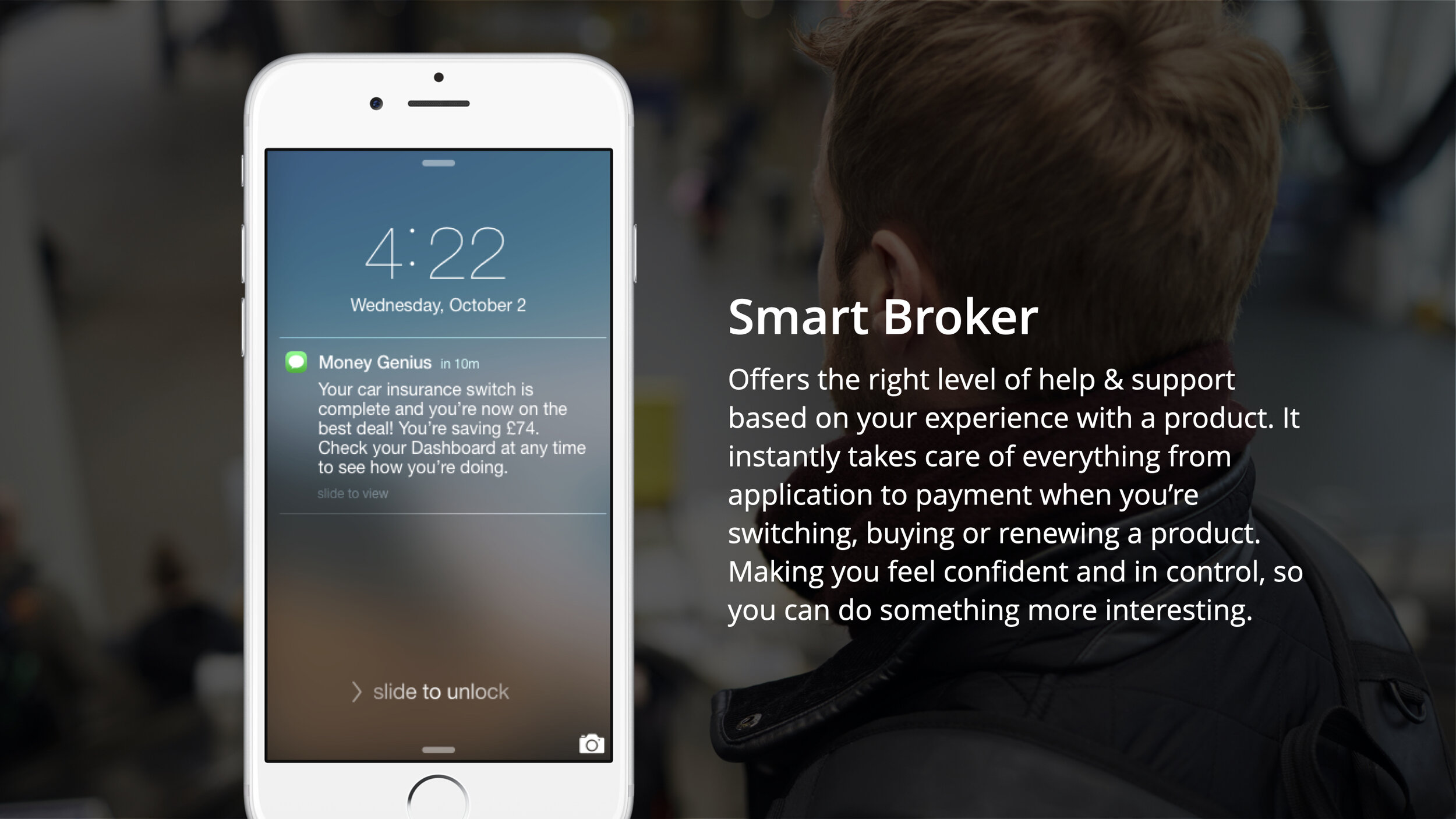

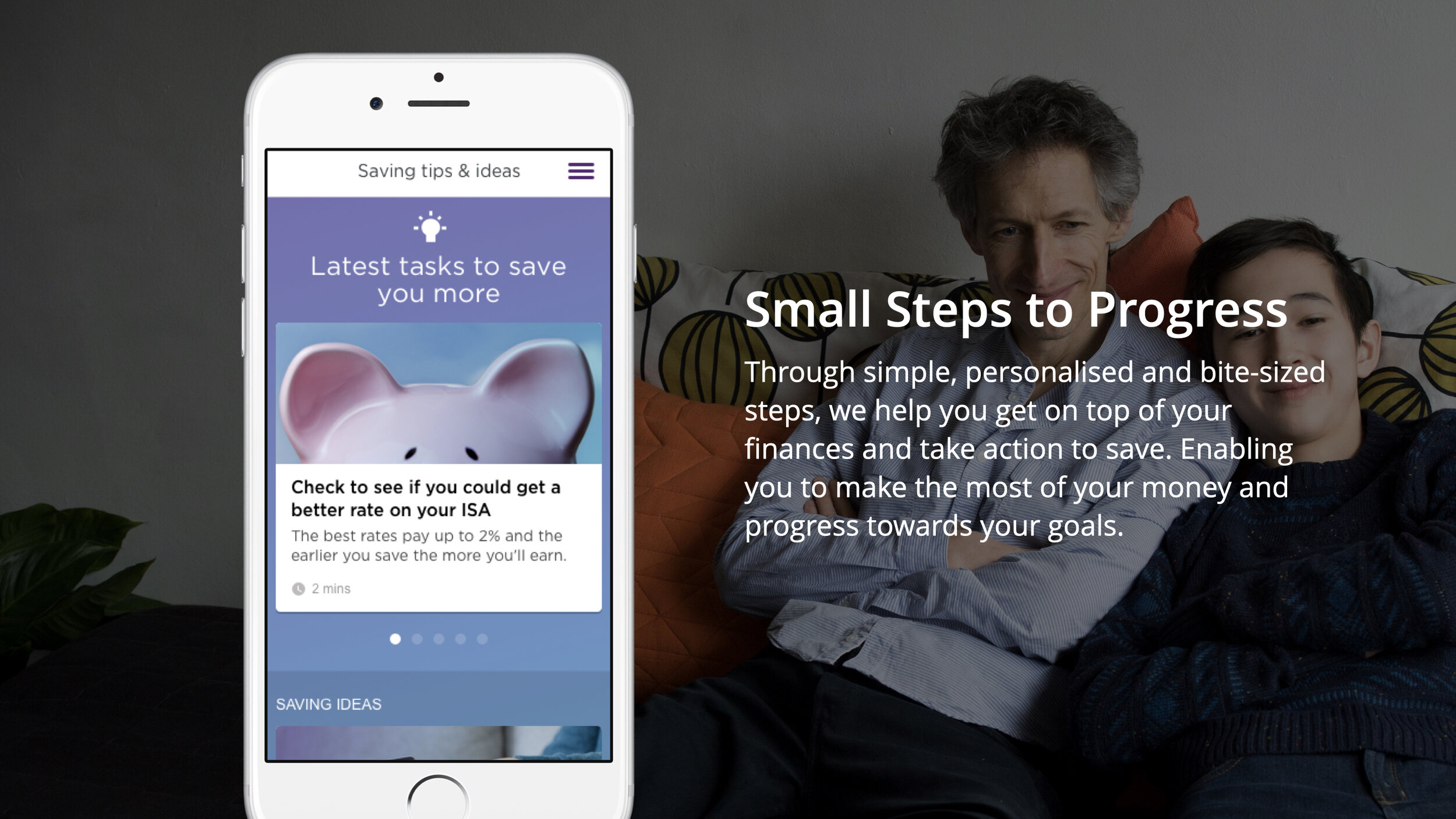

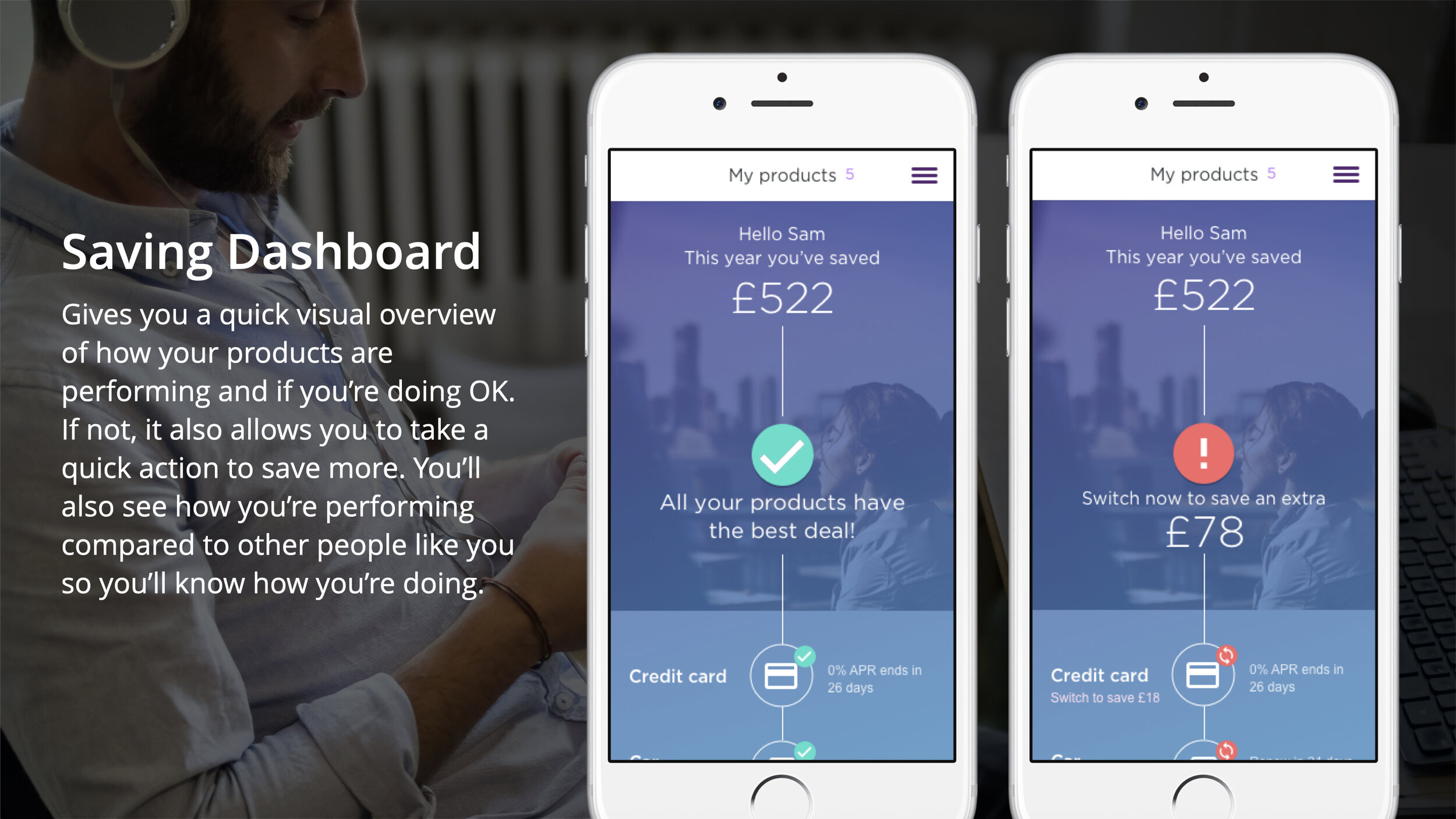

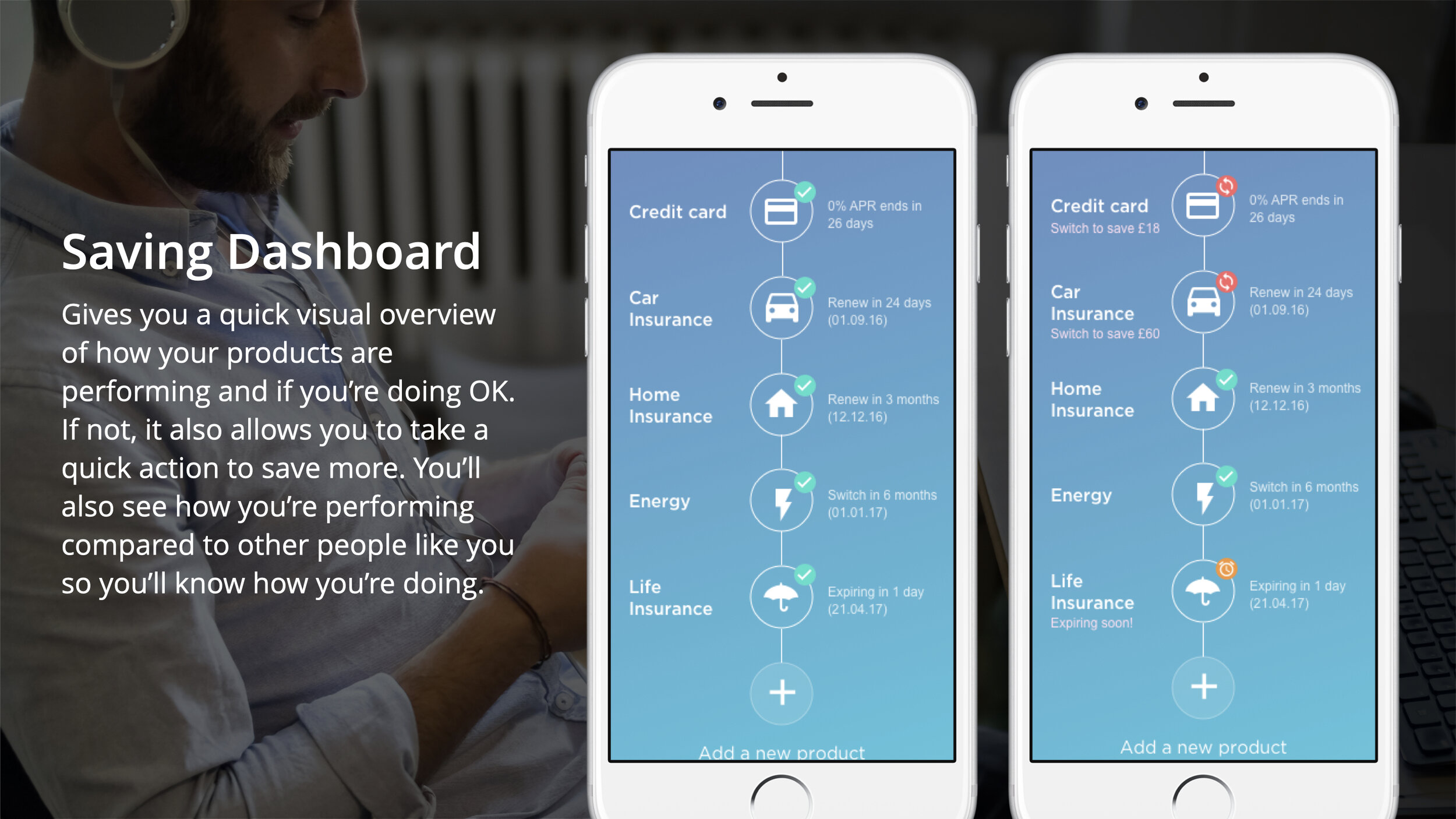

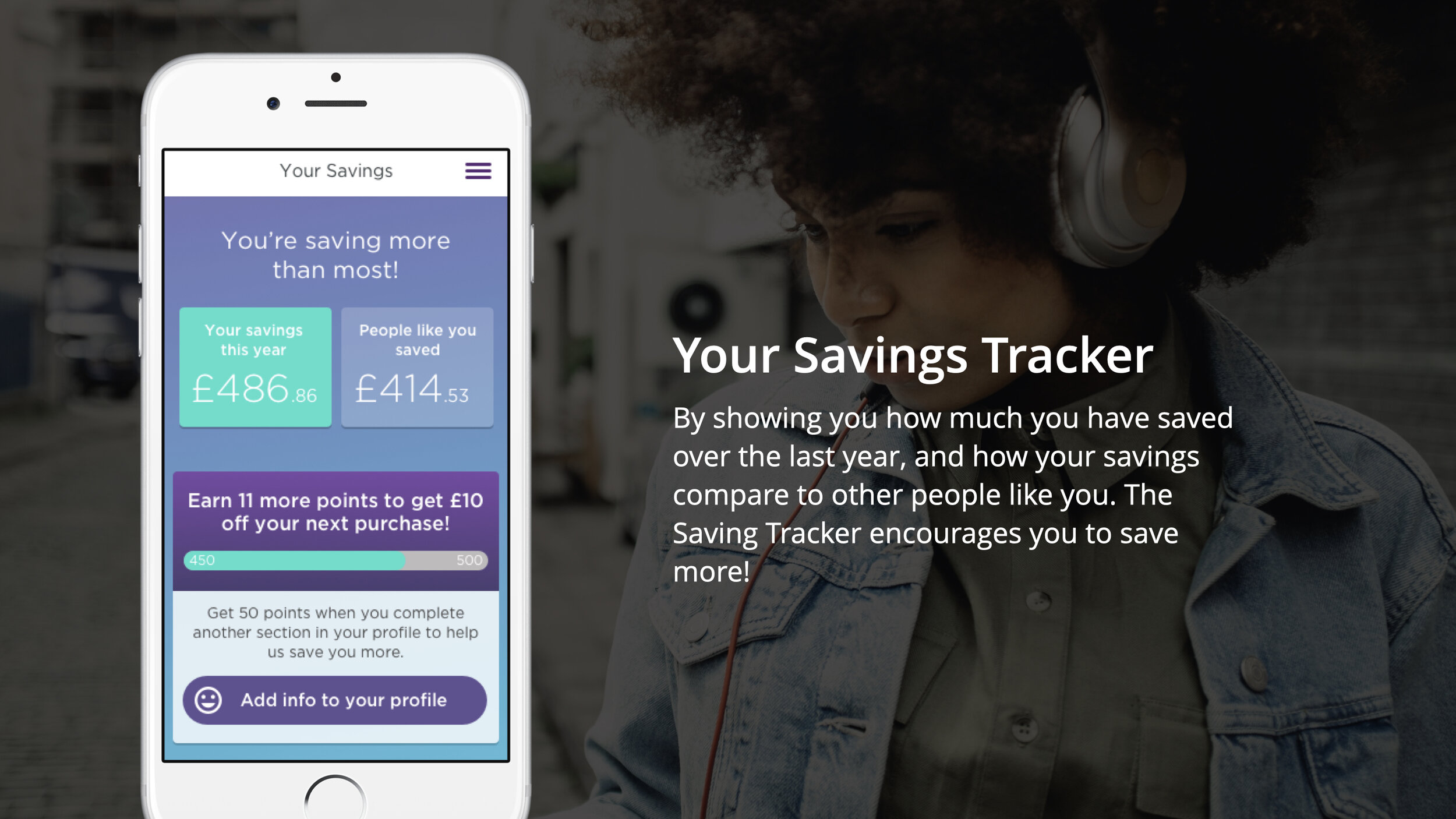

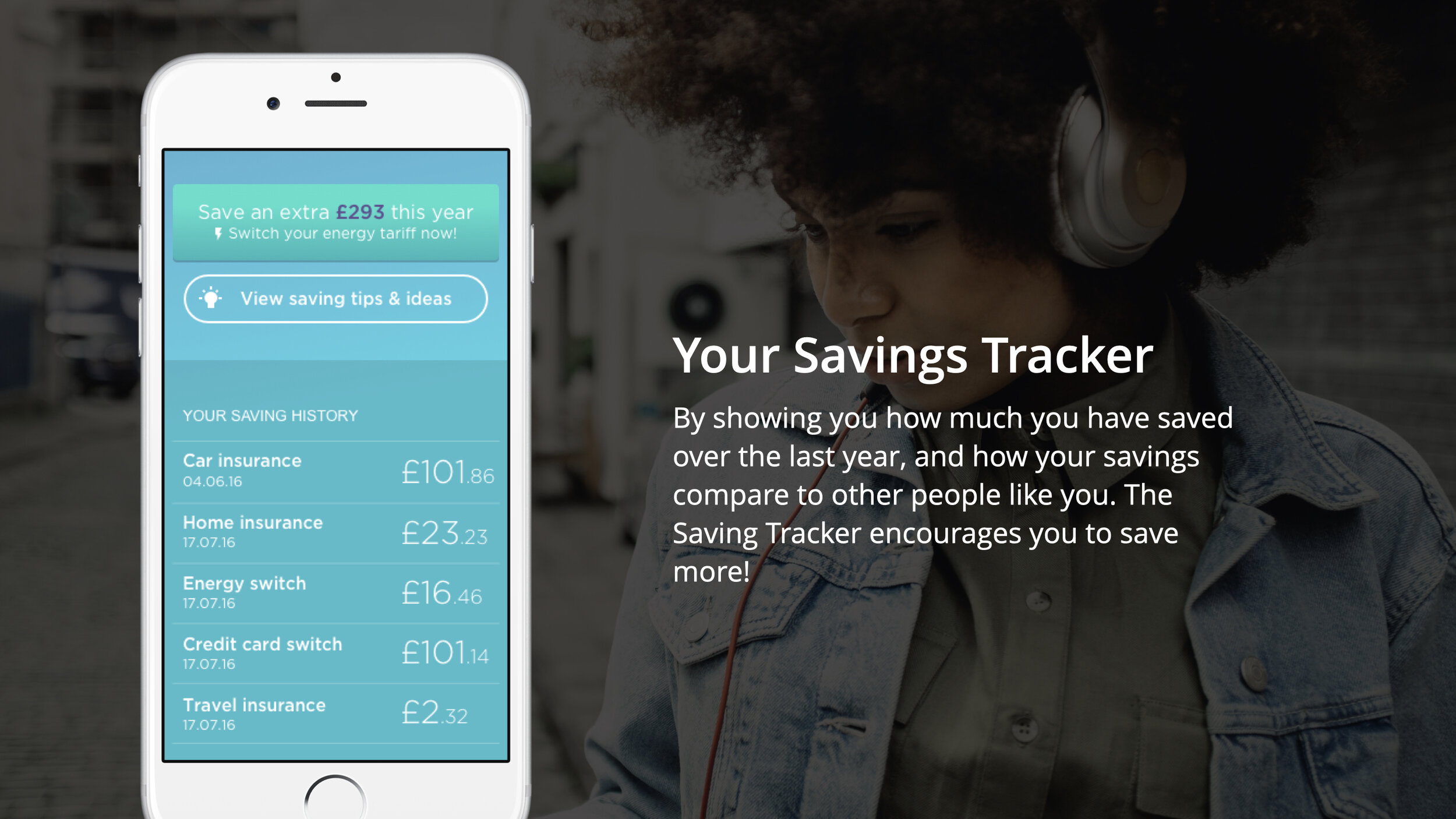

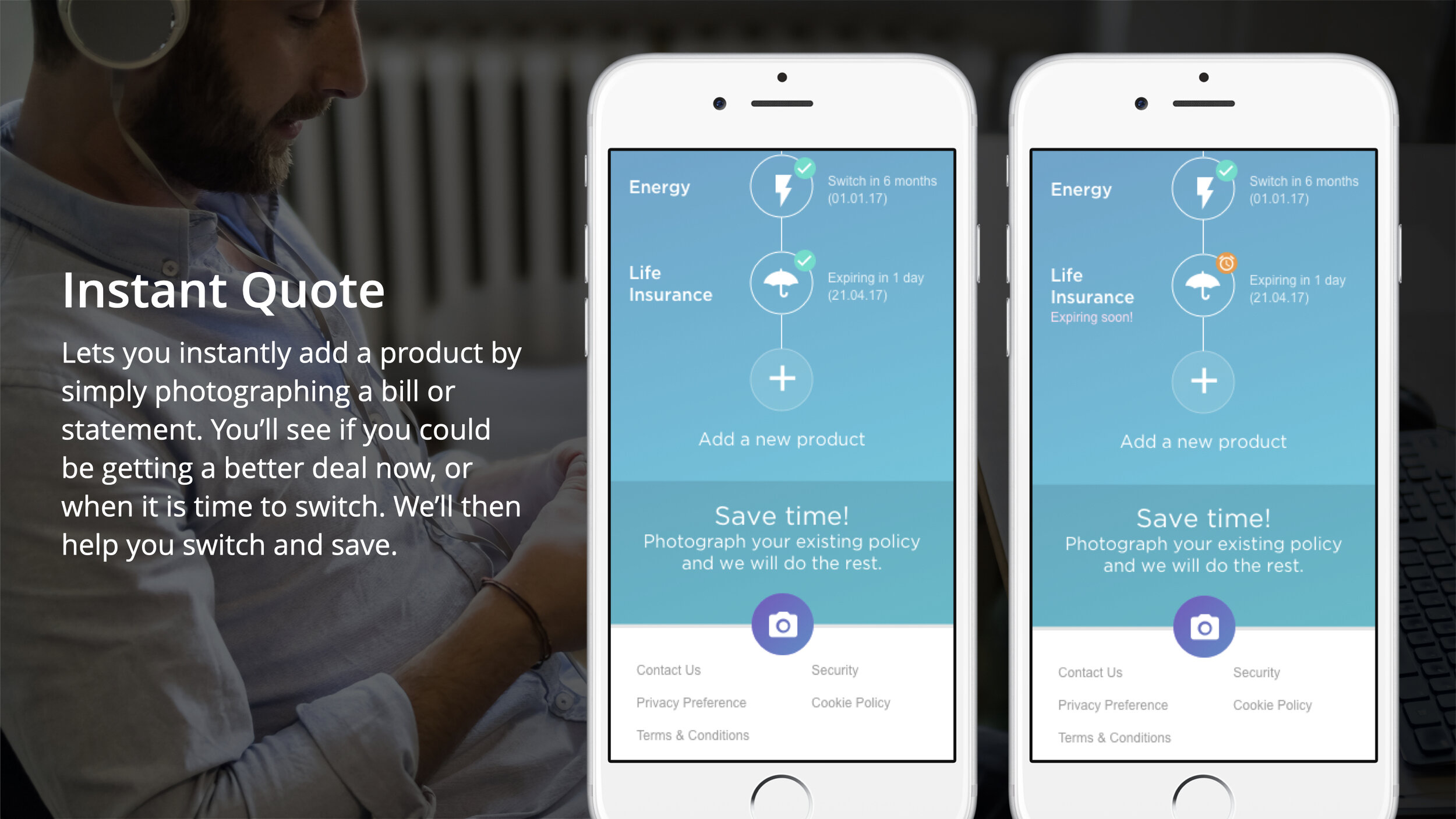

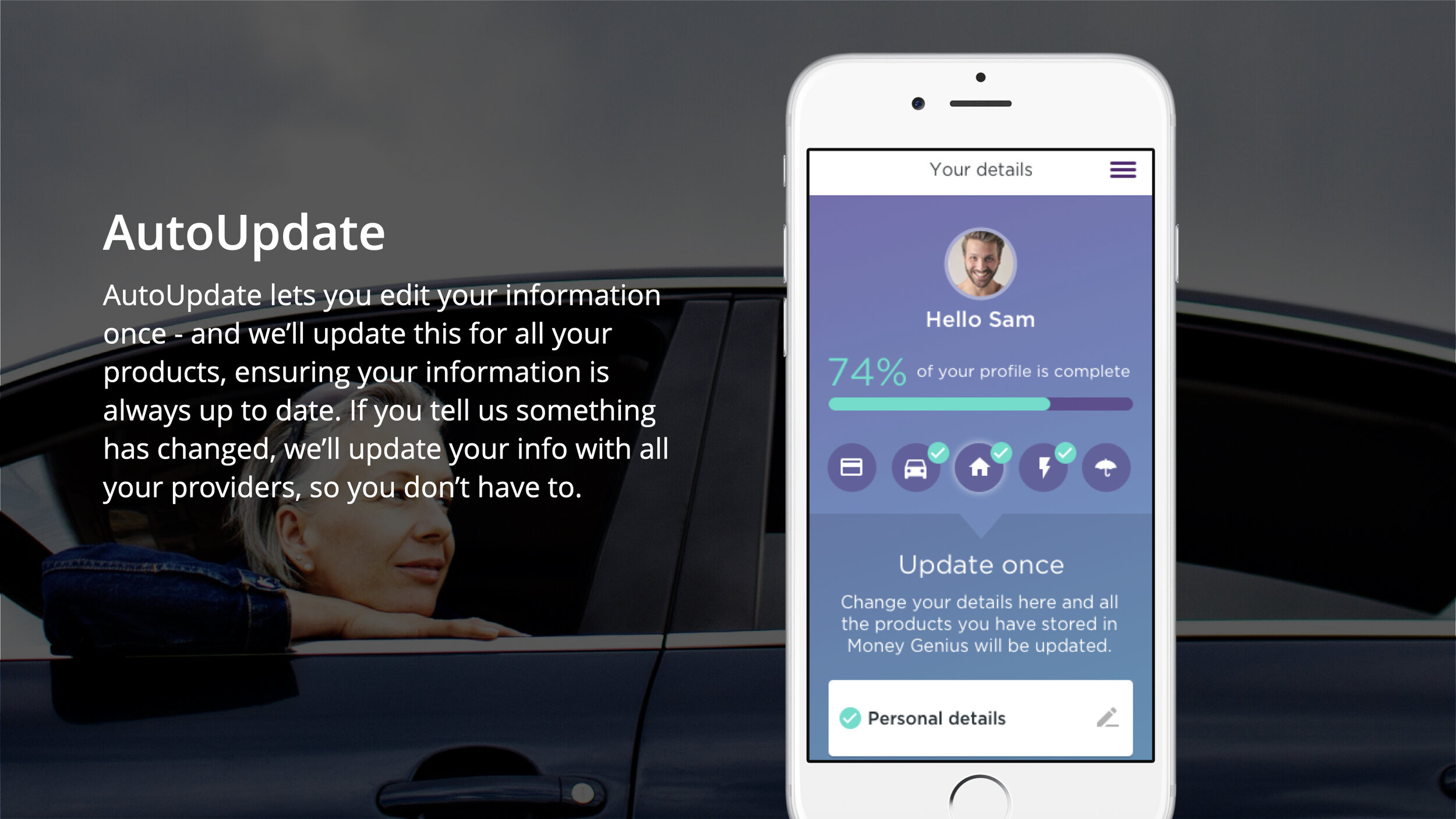

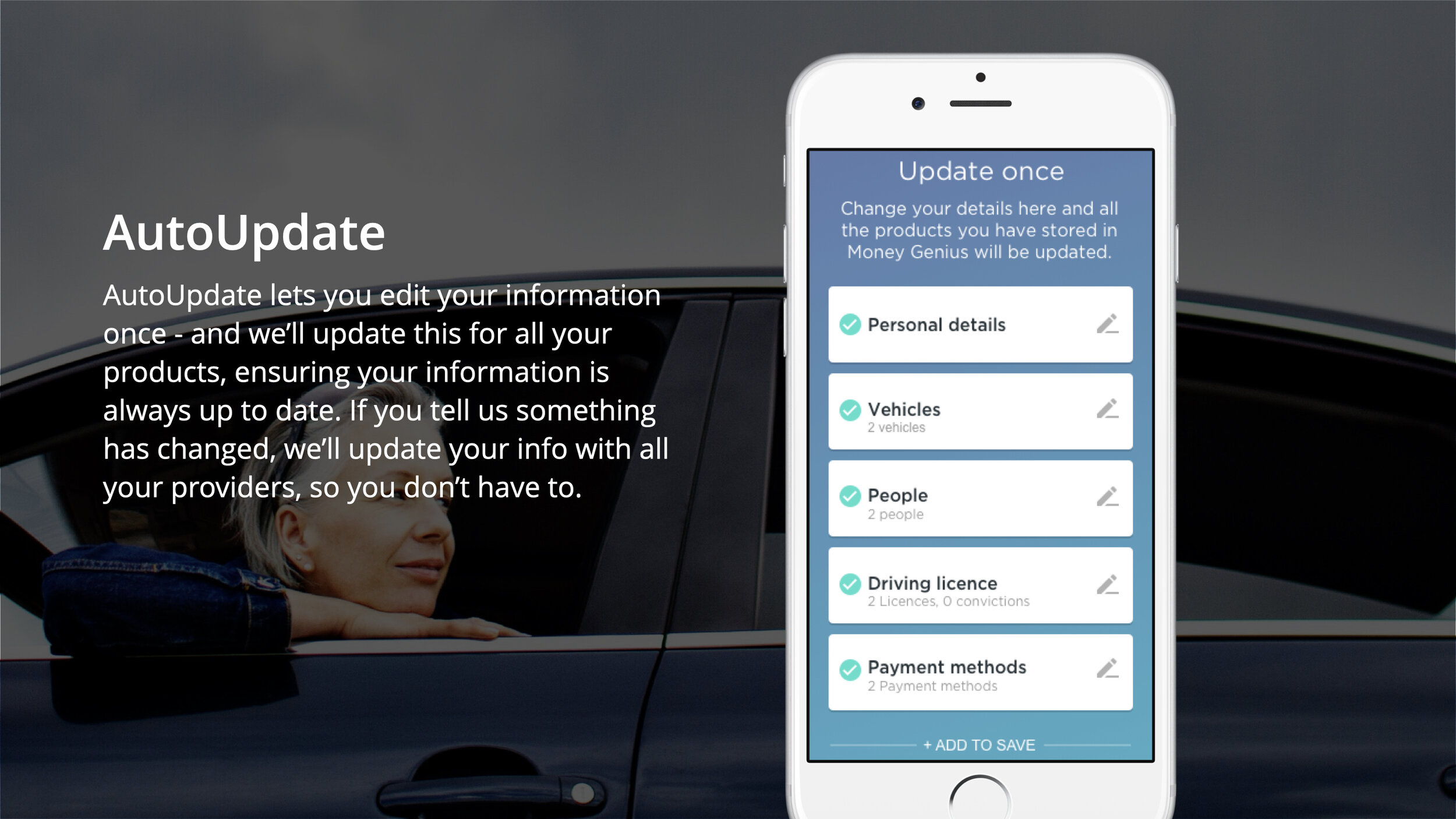

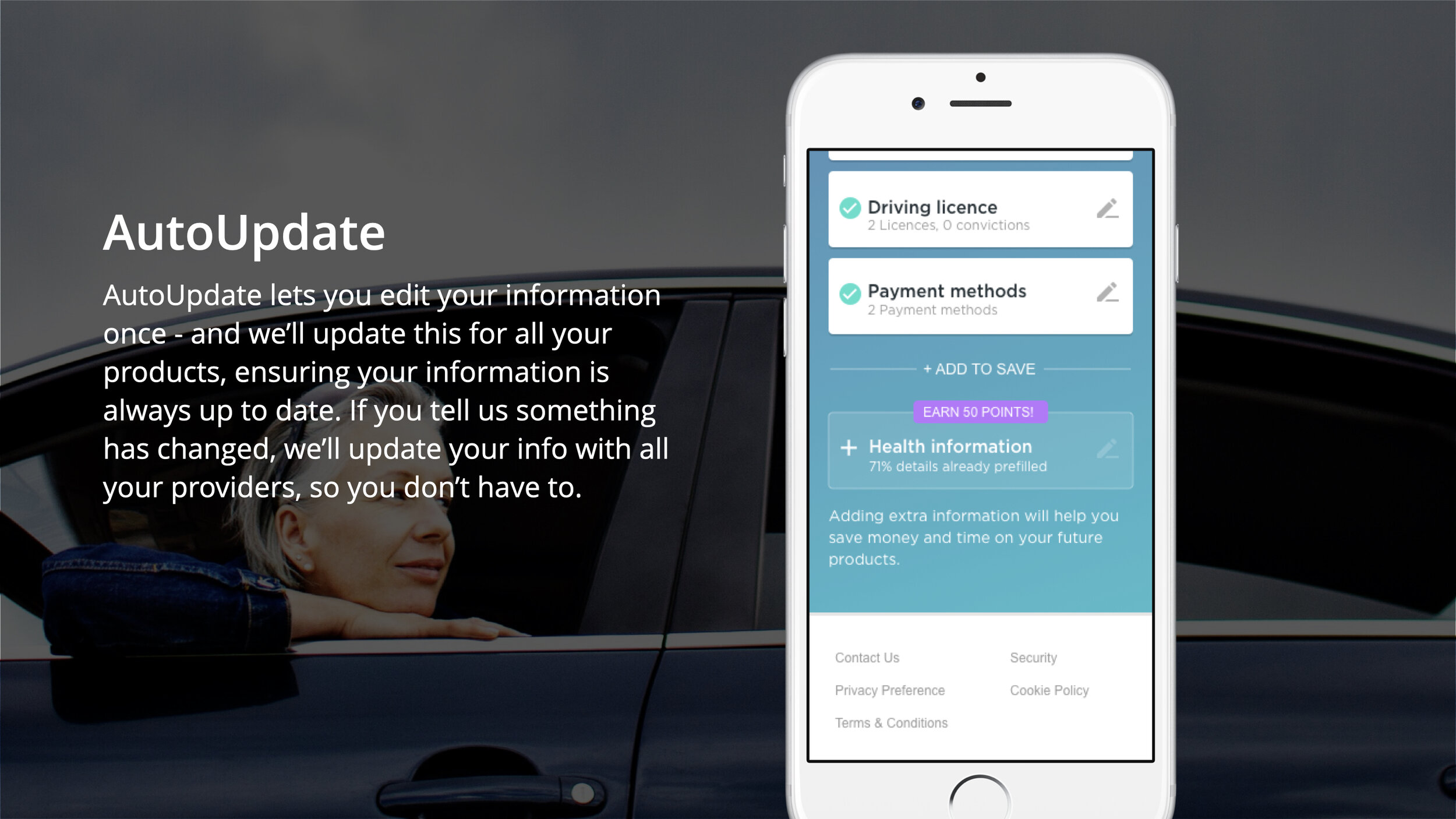

The updated system principles spoke to customer’s expectations that tools and services should be simple, intelligent and save them time especially when it comes to the complex and often boring task of personal finances. It also emphasised the proactive ‘constantly optimising’ element which didn’t wait for the user to start looking for better deals but automatically tracked the market and initiated money saving switches when they were available.

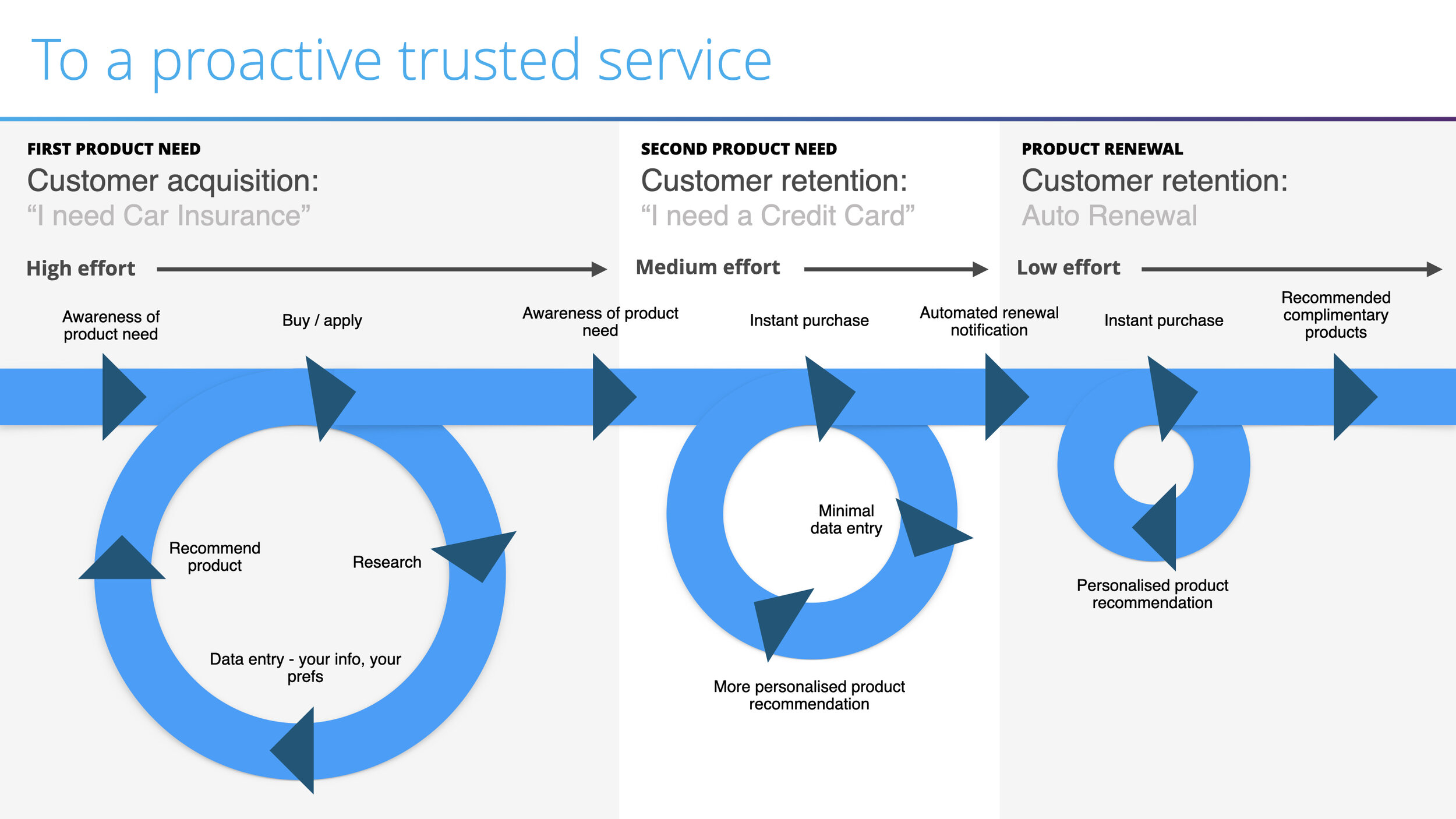

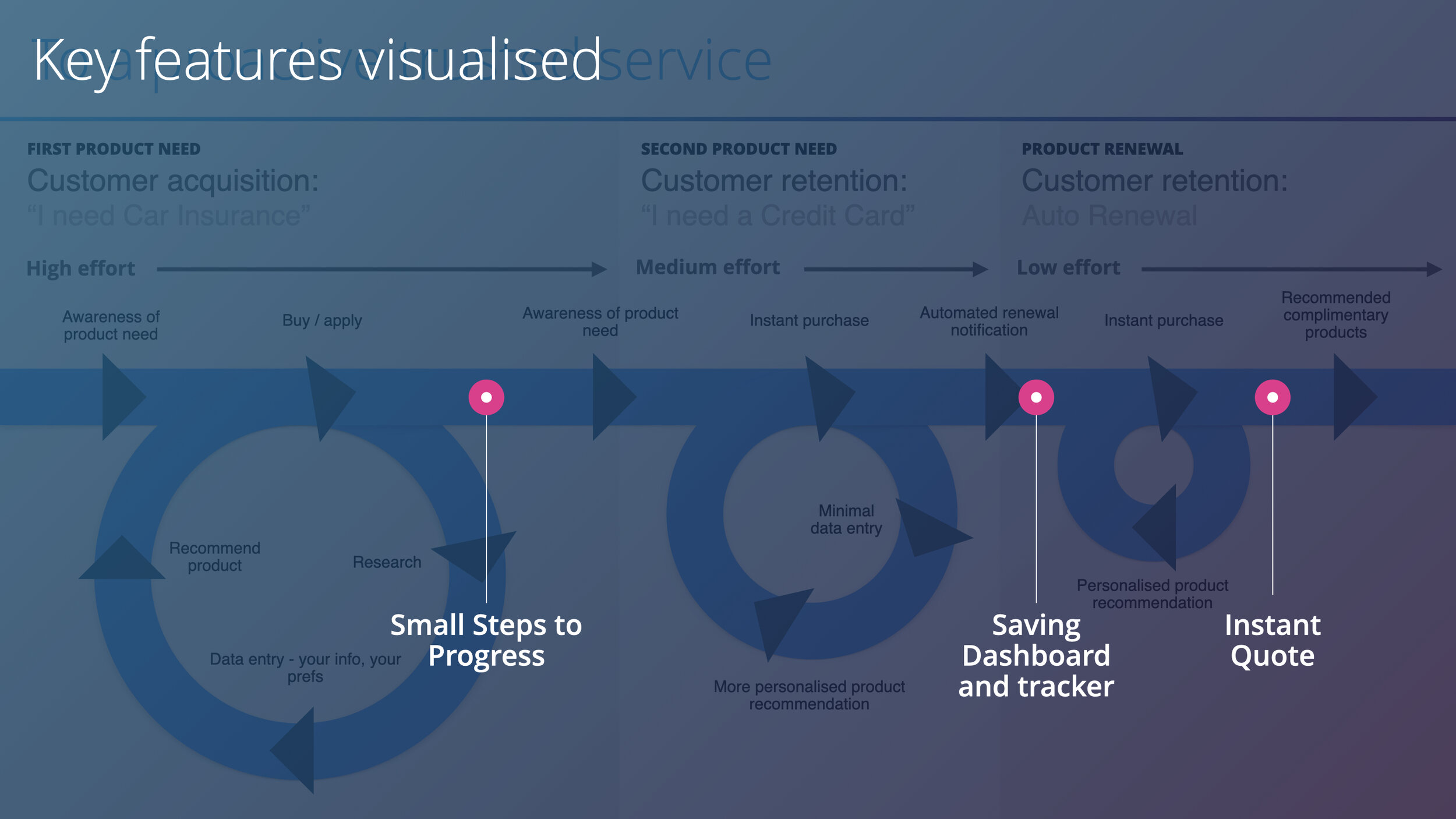

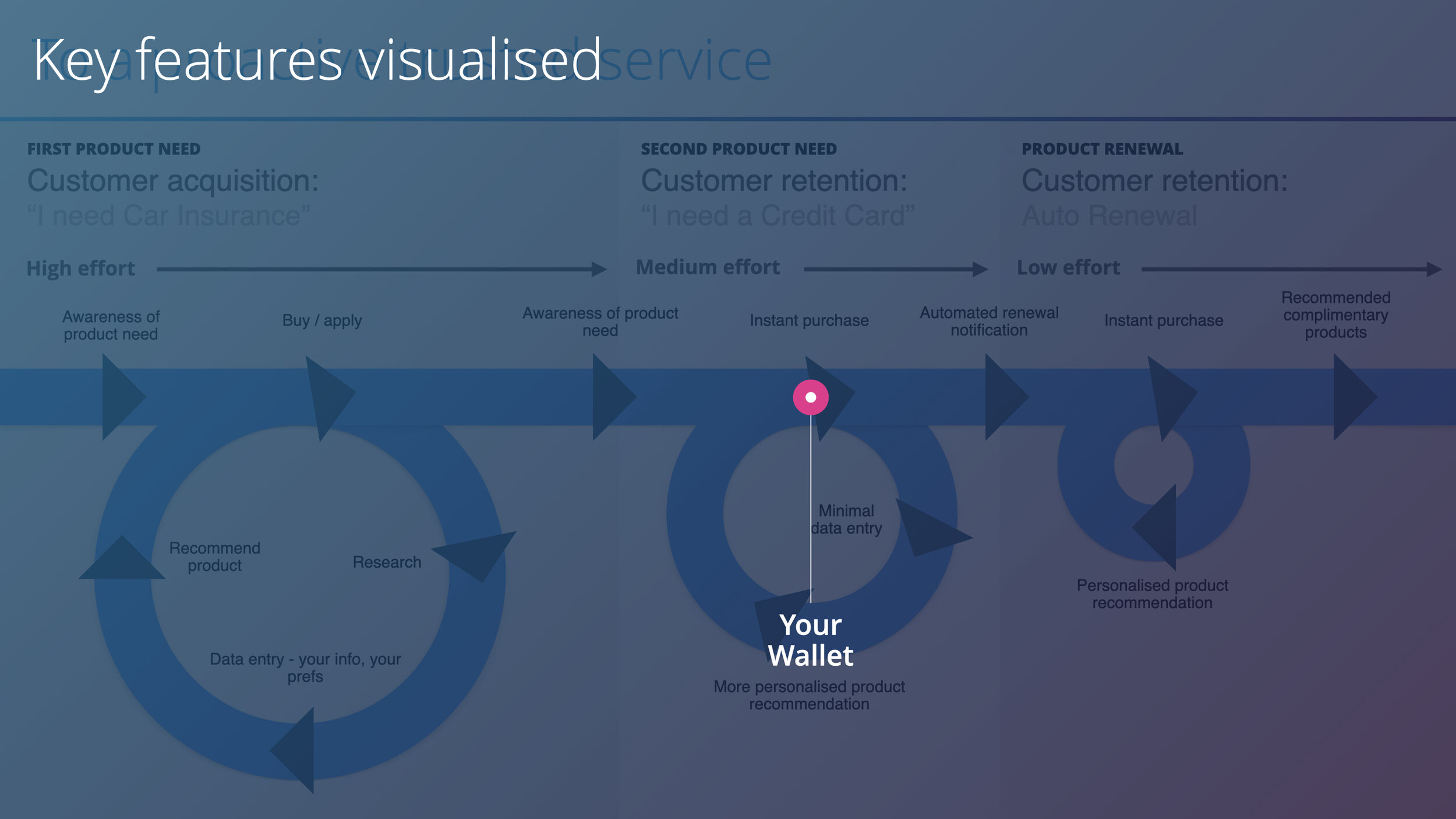

Part 2: Updated mapping Of The Customer Journey

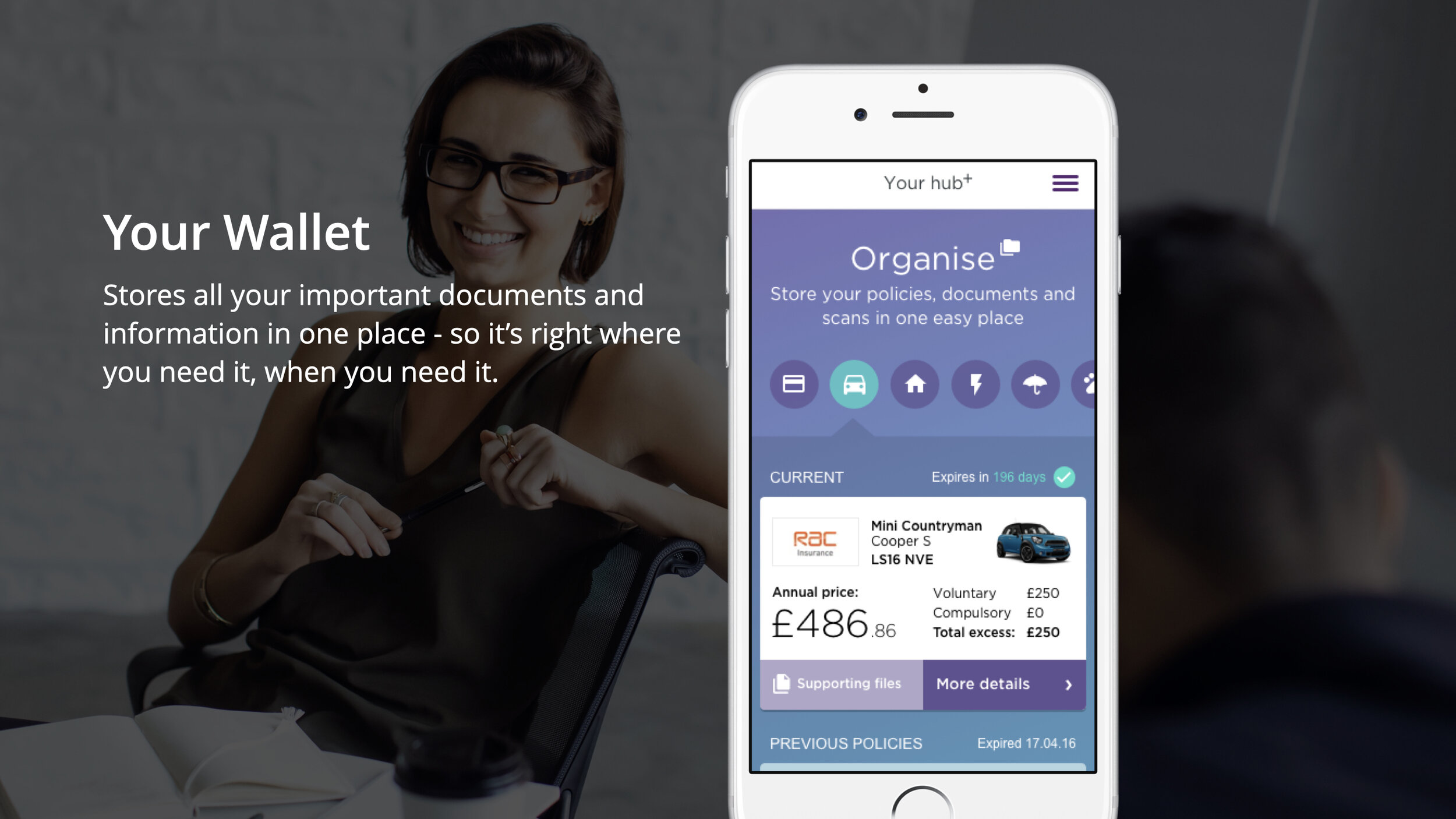

We proposed a more holistic way of looking at the a customer’s relationship with MSM by encompassing the customer’s financial life as a whole across their lifespan rather than categorising car insurance, home insurance, credit cards, energy providers (etc.) as separate tasks to each be thought about once a year just before the annual renewal.

A more intelligent service should be able to cross sell relevant and customised deals for energy providers based on what it already knows about you from your last home insurance renewal. Every interaction with the MSM service should become quicker, more intelligent and more effective based on its deeper understanding of your profile and preferences.

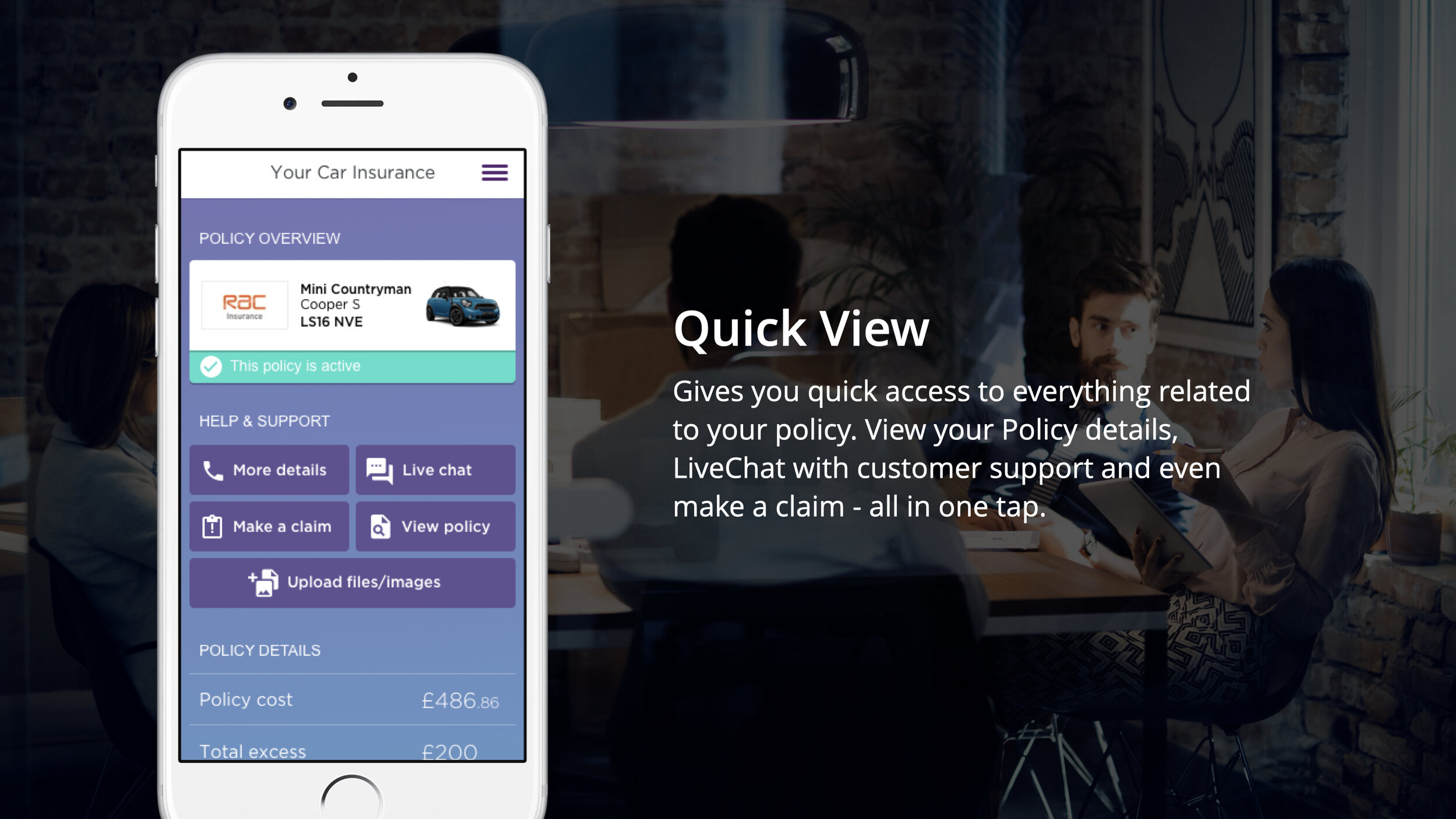

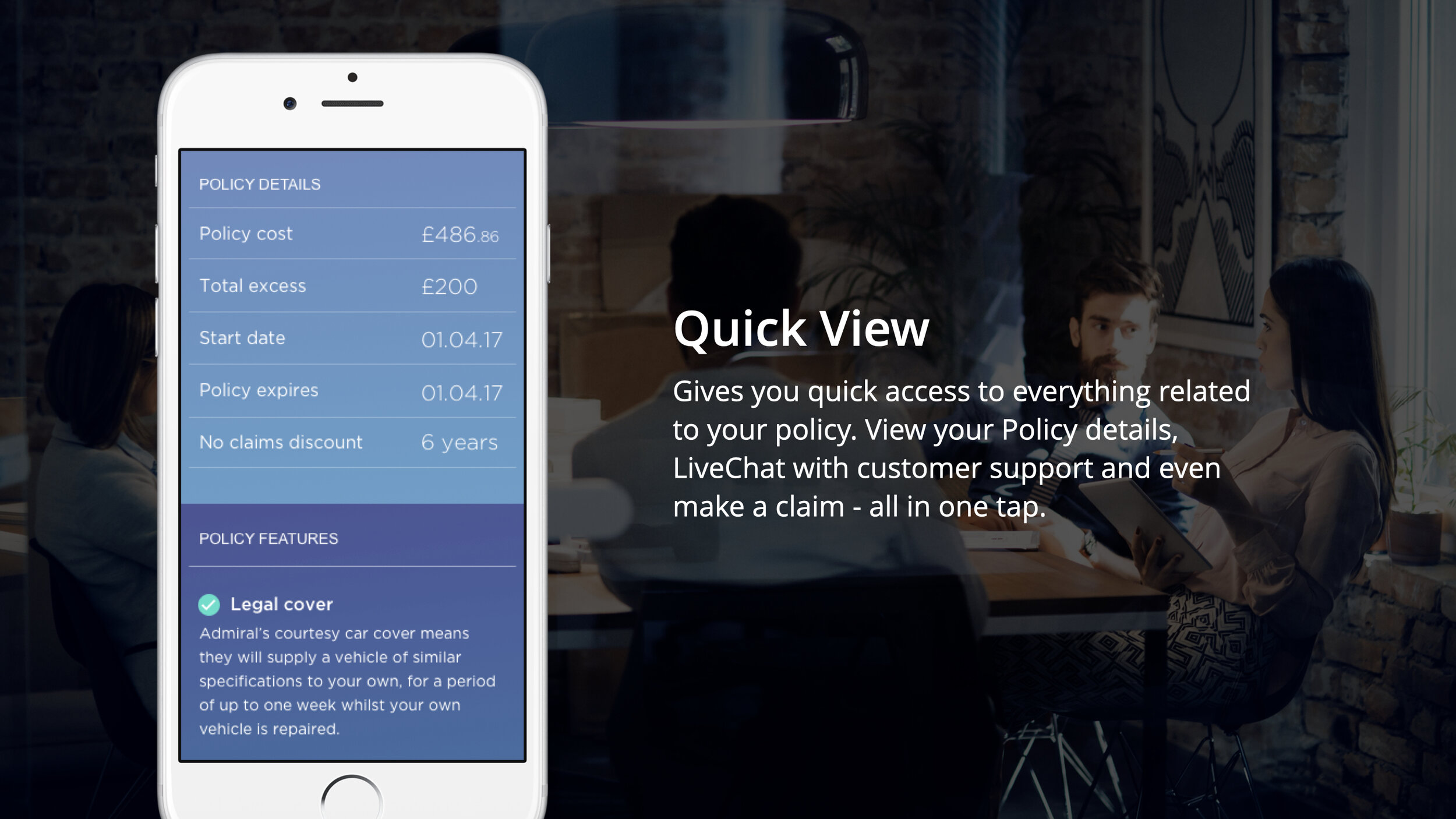

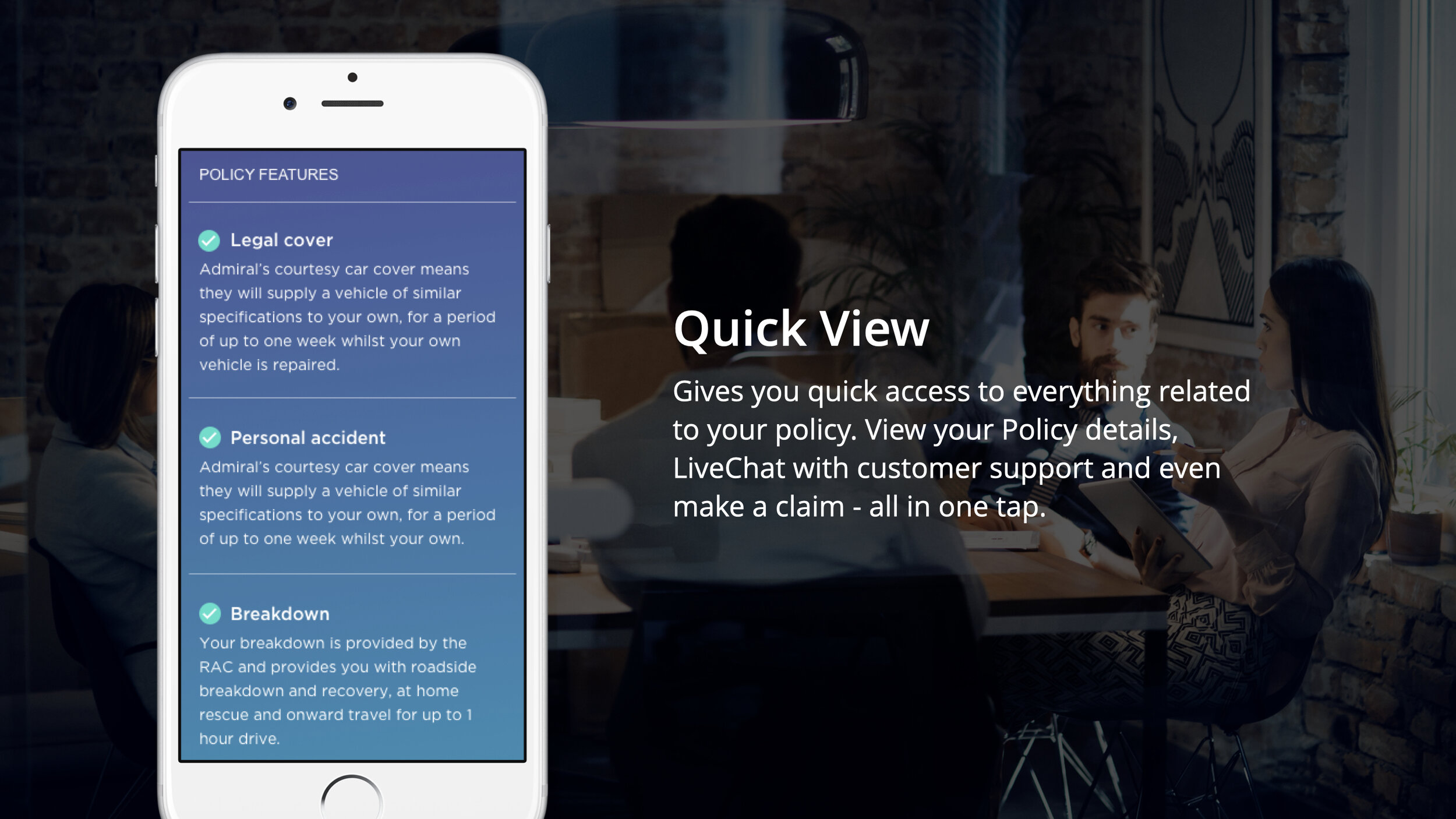

This broader mapping of the user journey allowed us to discover pain points and opportunities where MSM could provide some innovative, proactive features within their mobile service that would set them apart from the competition.

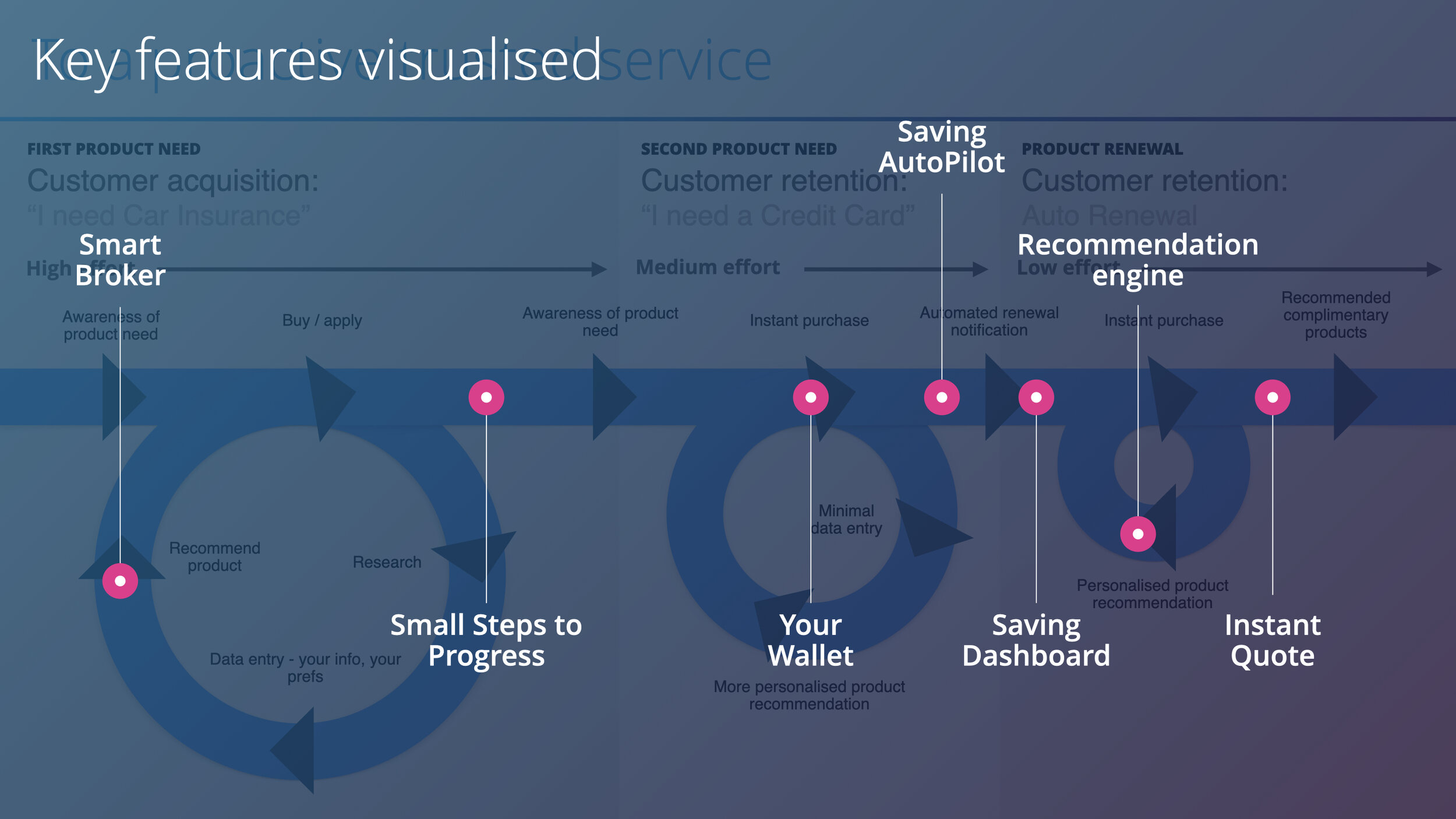

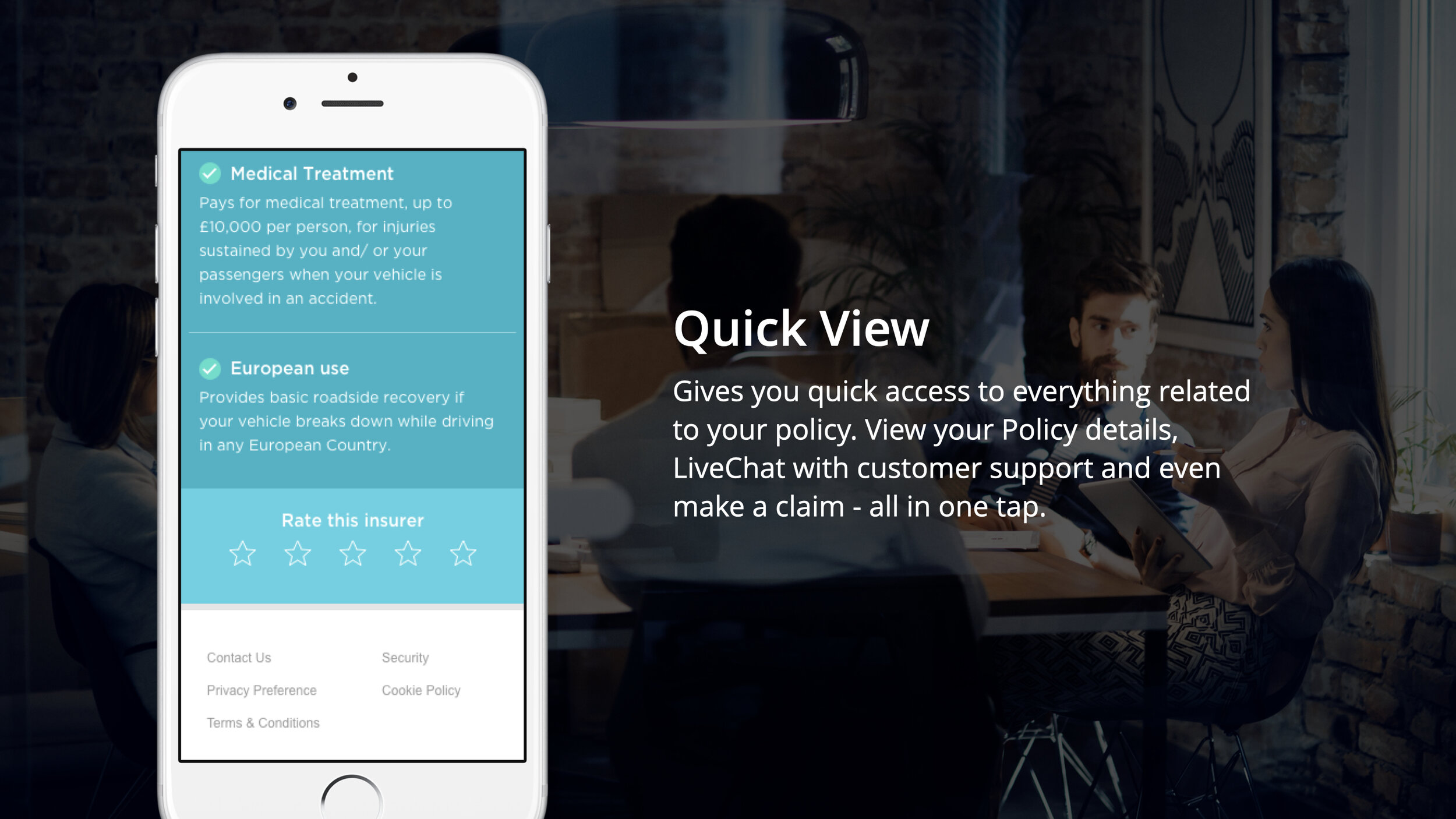

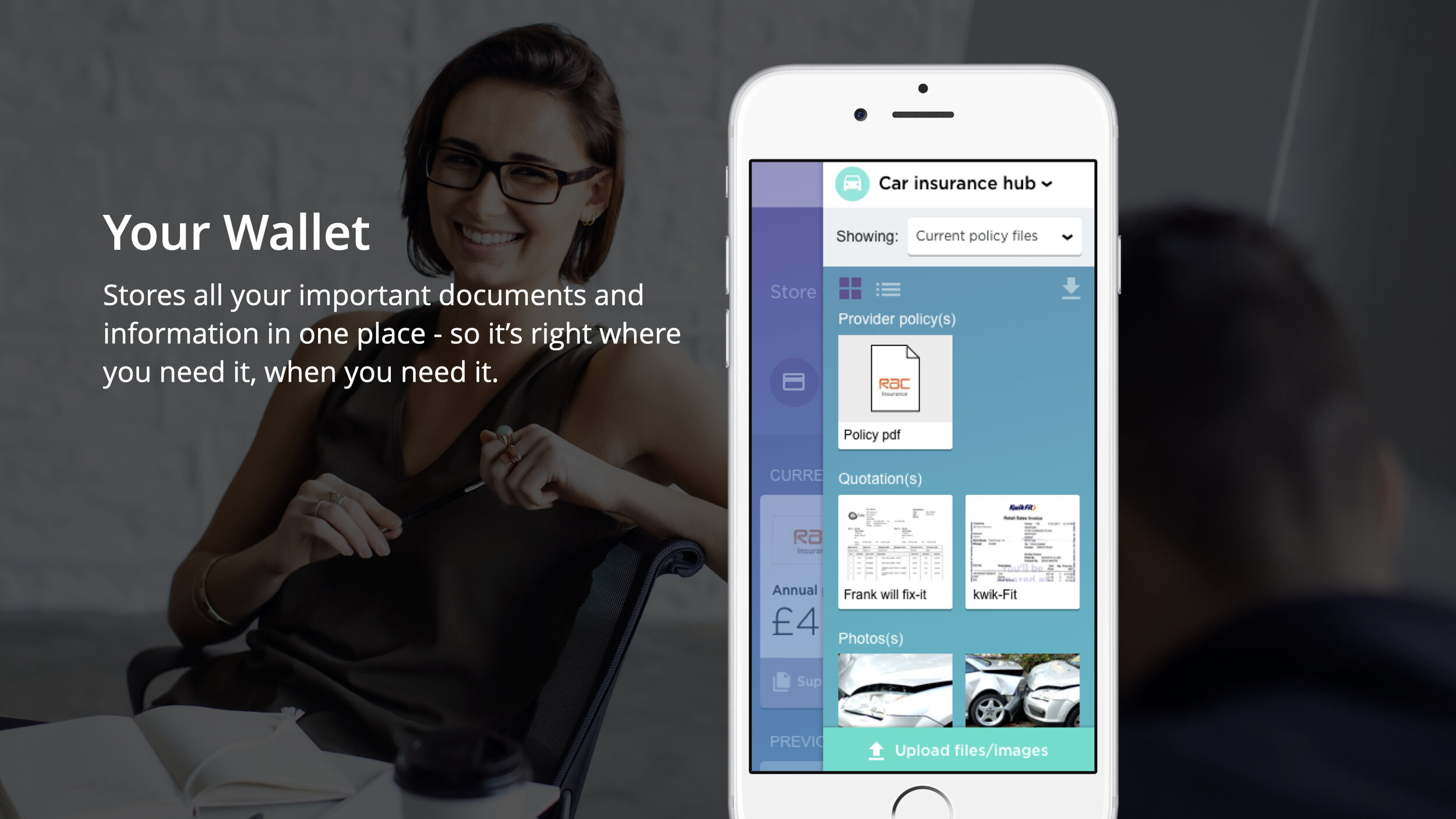

Part 3: Visualising Concept Features

As a team we used the pain points we’d discovered through the research and customer journey mapping exercise as a jump off point for creative idea generation. For each pain point we ideated dozens of concepts around each pain point that could provide the optimal experience for the user.

We ranked these ideas from most to least effective. We then filtered the most effective using two lenses:

Would this concept be feasible with the projected mainstream technology available in 3 years time

Was this concept viable given MSM’s brand values and mission

For the concepts that met all of these criteria we created a concept user experience and design look and feel using mood visuals shown below

RESULT

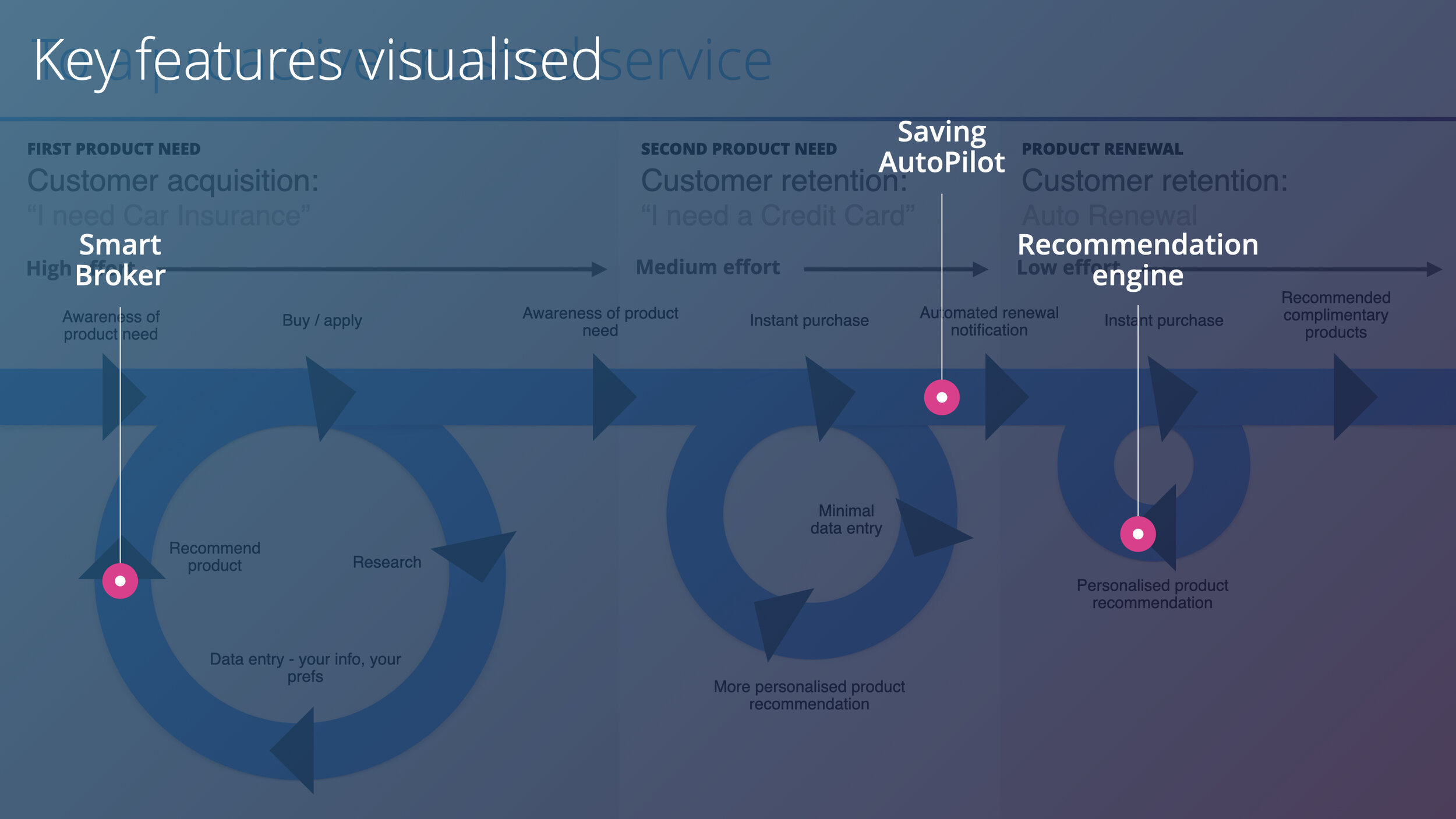

We presented our proposal to MSM’s senior stakeholders. It helped crystallise MSM’s move towards designing features that helped customer manage and grow their finances as well as saving.

In particular the senior team responded to the product ability to become more valuable to the user the more they used it. We successfully demonstrated how the product would become more personalised and require less input from the user - thus driving increased loyalty to MSM and giving the user a reason not to go to MSM's competitors.

“The ambition is to become a service that helps more customers save more money more easily, more often and sort out the mess that many people avoid confronting in their financial affairs.” Andrew Stocks – Head Of Design, MoneySupermarket